Introduction

In the dynamic world of mining and resource extraction, Westgold Resources Limited (ASX: WGX) has emerged as a key player in the Australian gold sector. On January 9, 2025, the company announced its preliminary production results for the second quarter of the fiscal year 2025 (Q2 FY25), showcasing a significant increase in gold production and a robust financial position. This article delves into the details of Westgold’s recent performance, its strategic initiatives post-merger with Karora Resources, and the promising outlook for the future.

Production Growth Post-Merger

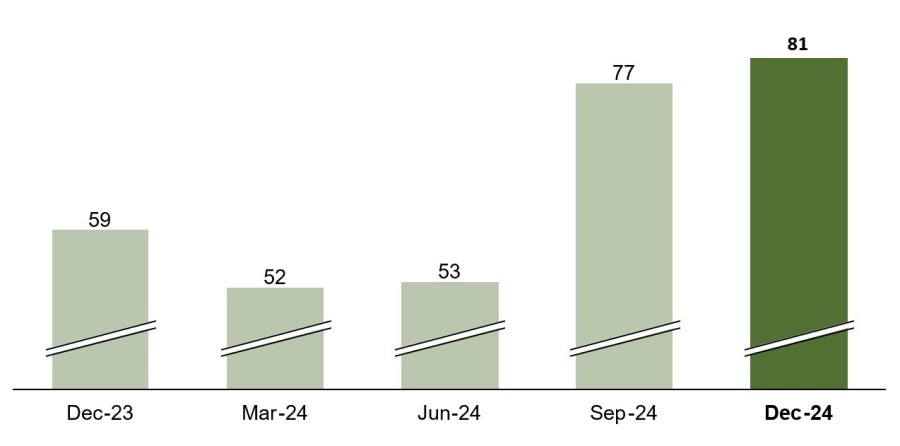

Since its merger with Karora Resources in August 2024, Westgold has been on an upward trajectory, consistently increasing its gold production quarter on quarter. In Q2 FY25, the company produced an impressive 80,886 ounces of gold, up from 77,369 ounces in the previous quarter (Q1 FY25). This brings the total production for the first half of FY25 to 158,255 ounces, with expectations for further growth in the latter half of the fiscal year. The company’s commitment to enhancing operational efficiency and production capabilities is evident in these results.

Operational Enhancements at Key Mines

Westgold’s operational strategy has focused on ramping up production at its flagship underground mines, namely Bluebird and Beta Hunt. At the Bluebird-South Junction, the company has concentrated efforts on improving the grade and consistency of mine production. This includes the implementation of a modified ground support regime aimed at bolstering safety and efficiency.

Simultaneously, significant infrastructure upgrades are underway at the Beta Hunt mine. These upgrades, which encompass enhancements to water, power reticulation, and ventilation circuits, are expected to be completed by the end of Q3 FY25. Such improvements are critical for increasing mine outputs and ensuring sustainable production levels.

Development of the Great Fingall Mine

Another exciting development for Westgold is the ongoing progress at the Great Fingall mine, located near Cue. The mine is on track for its first ore production, anticipated in Q4 FY25. This addition to Westgold’s portfolio is expected to further bolster the company’s production capabilities and contribute to its overall growth strategy.

Strong Financial Position

As of December 31, 2024, Westgold reported a robust financial position, with cash, bullion, and liquid investments totaling $152 million. Coupled with an undrawn $250 million from its $300 million corporate facility, the company boasts a financial liquidity of $402 million. This strong financial foundation provides Westgold with the flexibility to invest in growth initiatives and navigate the challenges of the mining sector.

Strategic Focus on Sustainable Production

Westgold’s Managing Director and CEO, Wayne Bramwell, emphasized the company’s commitment to optimizing its operations following the merger. The focus on sustainable production is evident in the ongoing investments in the principal mines located in the Murchison and Southern Goldfields regions. The company is advancing multiple growth projects simultaneously, with Bluebird-South Junction and Beta Hunt identified as key drivers of growth for H2 FY25.

In addition to ramping up production, Westgold is also exploring plant expansion studies at Higginsville, Bluebird, and Fortnum. Initial capital estimates for these expansions are expected to be reported shortly, indicating the company’s proactive approach to enhancing its operational capacity.

Looking Ahead: Challenges and Opportunities

While Westgold’s outlook appears promising, it is essential to acknowledge the inherent risks associated with mining operations. The company has issued forward-looking statements that highlight potential uncertainties, including fluctuations in commodity prices, regulatory changes, and environmental conditions. These factors could impact production outputs and overall performance.

However, Westgold’s management remains optimistic, citing the strategic initiatives in place to mitigate risks and enhance operational efficiency. The deployment of an underground drilling fleet across the group and active surface drill contractors at Peak Hill and Higginsville are indicative of the company’s commitment to extending mine lives and maximizing resource extraction.

Conclusion

Westgold Resources Limited is poised for continued growth in the Australian gold mining sector. With a solid production increase in Q2 FY25, strategic investments in key mines, and a strong financial position, the company is well-equipped to navigate the challenges of the industry. As Westgold prepares for the second half of FY25, stakeholders can look forward to further developments that promise to enhance the company’s operational capabilities and drive long-term value. The stage is set for Westgold to demonstrate the full potential of its expanded asset base, making it a company to watch in the coming years.