In the complex world of international trade, policies such as tariffs can have far-reaching consequences—both beneficial and detrimental. While it’s tempting to focus solely on the immediate advantages of such policies, it’s essential to consider the potential negative ramifications that can ripple through various sectors of the economy. One area where these effects are particularly pronounced is the precious metals market, which is intricately linked to global trade dynamics. This article explores how a prolonged trade war, characterized by tariffs and other trade barriers, could impact the precious metals markets, particularly gold and silver.

The Movement of Gold

Recent reports have highlighted a significant shift in the movement of gold, particularly from London to the United States. The looming threat of tariffs has driven up the futures prices of gold and silver in New York, creating price discrepancies that savvy traders have sought to exploit. This phenomenon is not merely a reaction to tariffs; it also underscores a more fundamental issue: the disparity between paper gold and physical metal availability.

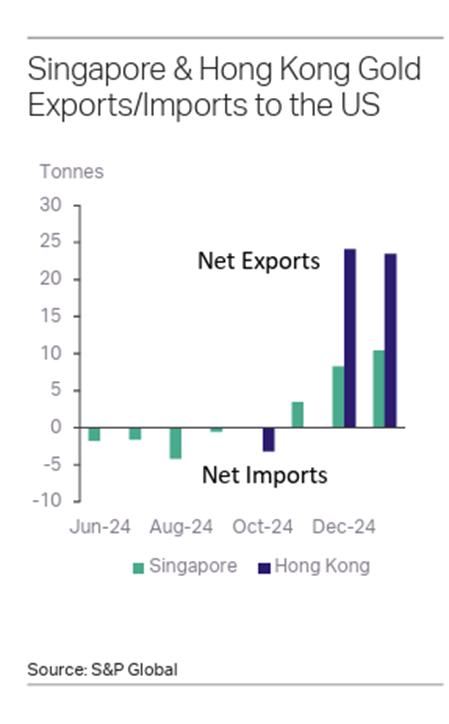

According to Metals Focus, approximately 600 tonnes of gold flowed into COMEX vaults in New York between December and February, with much of this gold originating from London. Additionally, Singapore and Hong Kong reported net outflows of around 70 tonnes. These outflows have tightened supplies of precious metals, leading to increased wholesale premiums. In South Korea, for instance, the state-run mint faced gold shortages and had to pause gold bar sales, illustrating the tangible effects of these market shifts.

The implications of tariffs on the precious metals market could be just the beginning. As trade tensions escalate, the movement of gold and other precious metals may continue to be influenced by changing policies and market dynamics.

The Electronics Sector

Silver, along with gold, plays a crucial role in the electronics sector, where industrial demand accounts for over 50 percent of annual silver consumption. This demand is primarily driven by applications in electronics and solar energy. In fact, industrial demand for silver is projected to rise by 7 percent this year, surpassing 700 million ounces for the first time. The previous year saw a record of 654.4 million ounces in industrial demand, largely fueled by green energy applications.

The initial trade war under the Trump administration significantly altered the landscape of electronics and semiconductor supply chains. In 2018, the U.S. imposed over $400 billion in tariffs on Chinese imports, prompting many companies to diversify their supply chains into regions like Southeast Asia, India, Mexico, and Central and Eastern Europe. During this period, gold prices surged, eclipsing $1,500 an ounce for the first time in six years by mid-2019.

The COVID-19 pandemic further disrupted these supply chains, as China’s stringent lockdowns halted global electronics production. In response, companies adopted a “China+1” strategy to mitigate future risks, decentralizing their supply chains. Metals Focus noted that Vietnam has emerged as a vital hub for electronics manufacturing, while Thailand has become the largest producer of printed circuit boards in Southeast Asia.

However, despite these shifts, electronic exports to the U.S. remain vulnerable to tariff policies. The recent announcement of large-scale reciprocal tariffs has thrown the electronics industry into turmoil. Multinational manufacturers, who have relied on free trade agreements to build their supply chains, now face significant challenges in adjusting their operations to comply with new U.S. policies.

Solar Energy

The solar energy sector is increasingly reliant on silver, which is the best conductor of electricity among metals at room temperature. Research indicates that solar manufacturers may require over 20 percent of the current annual silver supply by 2027, with projections suggesting that by 2050, solar panel production could consume up to 98 percent of existing global silver reserves.

China currently dominates the photovoltaic sector due to its technological advantages and production capacity. In an effort to bring solar manufacturing back to the U.S., the Biden administration raised tariffs on silicon-based solar products and critical metals imported from China to 50 percent. These tariffs have since been expanded to include modules produced in Southeast Asia.

However, the U.S. faces significant challenges in this endeavor. Insufficient production capacity for upstream raw materials, such as wafers and polysilicon, along with key components sourced primarily from Chinese companies, hampers the industry’s autonomy. Even with tariff protection, production costs in the U.S. remain approximately 20-30 percent higher than in China, limiting competitiveness. As a result, China’s dominance in the photovoltaic market is expected to persist in the near term.

The Automotive Sector

The automotive industry is another sector poised to feel the effects of tariffs. Platinum and palladium, essential components of catalytic converters, are already experiencing significant supply tightness. While imposing tariffs on imported vehicles may seem like a strategy to boost U.S. manufacturing, the reality is more complex. The U.S. auto industry relies heavily on imported parts, with Mexico supplying about 40 percent and Canada an additional 20 percent.

Analysts project that a 25 percent tariff could lead to increased vehicle prices, negatively impacting the entire sector. If the U.S. auto market were to lose one million units in sales due to tariffs, demand for platinum group metals could fall by 160,000 ounces. This scenario not only affects car manufacturers but also has broader implications for the global precious metals market, influencing investment and production planning in related industries.

Conclusion

The landscape of global trade is shifting, and tariff policies are driving significant changes in supply chains, including the movement of precious metals. As the U.S. and other regions enact and propose new policies, the global production and trade landscape will continue to evolve. Companies are contemplating relocating production bases to mitigate the effects of tariffs, but trade disputes may lead to retaliatory tariffs, introducing further uncertainty into the redistribution of global industrial chains.

While tariffs may not significantly boost industrial demand in the U.S. due to increased production costs, the competition for key raw materials and advanced technologies is likely to intensify. As we navigate this complex terrain, it becomes increasingly clear that the consequences of tariffs extend far beyond immediate economic gains, affecting industries and markets in ways that require careful consideration and strategic planning.