President Donald Trump’s recent announcement of sweeping import tariffs has sent shockwaves through the global economy, raising numerous questions about the future of international trade. While the immediate reaction from financial markets has been bearish, particularly for energy sectors, there are several silver linings for oil and gas traders that merit consideration.

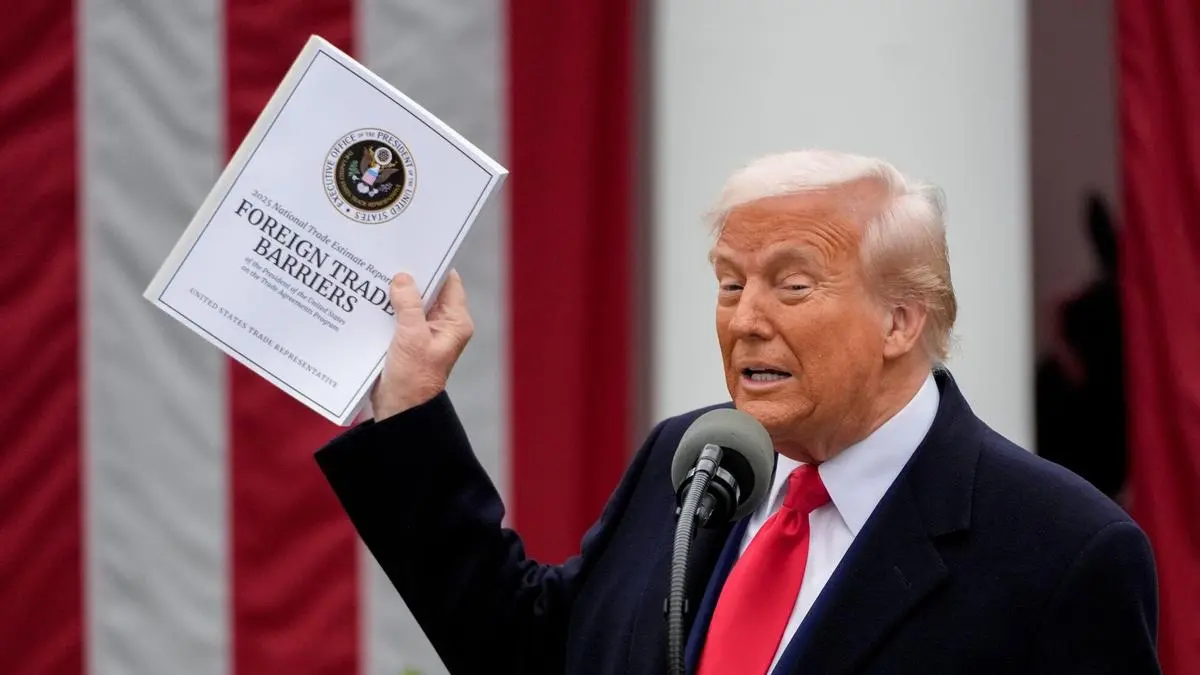

A Bold Move in the Rose Garden

In a high-profile event held in the White House Rose Garden, President Trump unveiled a series of tariffs targeting imports from several major trading partners. The proposed tariffs include a hefty 20% on goods from the European Union, 24% on Japan, 27% on India, 10% on Britain, and a staggering 34% on China. Additionally, a baseline 10% tariff on all imports was established, intensifying the ongoing trade war and drawing sharp criticism from world leaders.

The immediate conclusion drawn by many analysts is that these tariffs are likely to exert downward pressure on global economic prospects, which in turn could negatively impact oil and gas prices. Following the announcement, financial markets reacted swiftly, with benchmark crude oil prices, such as Brent, dropping approximately 2.5% to around $73 a barrel. However, it is essential to note that this price is still higher than it was a month ago, before escalating tensions in the Middle East and U.S. tariffs on Venezuela.

Navigating the Fog of Policy

Despite the initial bearish sentiment, energy markets may not be as grim as they appear. The volatility in the short term is expected as traders grapple with the implications of these tariffs. However, once the dust settles, the oil and gas industry may find itself in a more favorable position than anticipated.

Clarity Amidst Uncertainty

One of the key benefits of Trump’s tariff announcement is the clarity it provides to the energy sector. While the proposed tariffs may shift in the coming months as negotiations unfold, the baseline has been established. Importantly, U.S. imports of oil, gas, and refined products have been exempted from these tariffs, allowing the industry to breathe a partial sigh of relief.

The United States continues to import significant quantities of oil due to its robust refining capacity, which stands at 18.4 million barrels per day. In 2024, the U.S. imported 6.6 million barrels per day, with Canada and Mexico being the primary sources. Had tariffs been imposed on Canadian crude, U.S. refiners could have faced challenges in sourcing the heavy grades they require.

Maintaining Dominance in Global Energy Markets

Despite the potential disruptions caused by these tariffs, it is unlikely that the United States will lose its dominant position in global energy markets. In 2024, the U.S. emerged as the world’s top exporter of liquefied natural gas (LNG), surpassing Qatar and Australia, with a significant portion of its exports directed toward the European Union.

Moreover, the U.S. exported 4.1 million barrels per day of crude oil last year, a tenfold increase from a decade ago. European nations, which imported nearly half of these volumes, are unlikely to impose tariffs on U.S. energy imports due to their limited alternative sources of supply. Higher energy costs could hinder these countries’ economic growth, making them more inclined to maintain strong energy ties with the U.S.

A Shift in Global Economic Dynamics

Trump’s tariff strategy signals that he is serious about the trade war, which may prompt other countries to reassess their reliance on U.S. imports. This could lead to increased domestic investments and a push for self-sufficiency, ultimately driving demand for oil and gas. For instance, Germany’s recent pivot toward increased defense and infrastructure spending, along with China’s efforts to boost domestic consumption, may be early indicators of this shift.

While fragmentation of the global economy could introduce inefficiencies and higher consumer prices, it may also foster the development of new industries and transportation routes. As nations respond to Trump’s tariffs, energy traders may continue to express concern about the potential impacts on oil and gas consumption. However, the industry may emerge from this “Liberation Day” with its core strengths intact.

Conclusion

In summary, while President Trump’s sweeping import tariffs have cast a shadow over the global economy, the oil and gas sector may find reasons for optimism. The clarity provided by the tariff announcements, the exemption of energy imports, and the continued dominance of the U.S. in global energy markets all suggest that the industry could navigate these turbulent waters with resilience. As the world adjusts to this new trade landscape, energy traders will need to remain vigilant, but the outlook may not be as bleak as it initially appears.