Cerrado Gold Inc., a Toronto-based gold production and exploration company, recently announced its operational and financial results for the fourth quarter of 2024. The company, which operates the Minera Don Nicolás (MDN) gold project in Argentina and the Mont Sorcier High Purity DRI Iron Project in Quebec, has demonstrated resilience in a challenging economic environment. This article delves into the key highlights of Cerrado’s performance, financial results, and future outlook.

Annual Production and Financial Performance

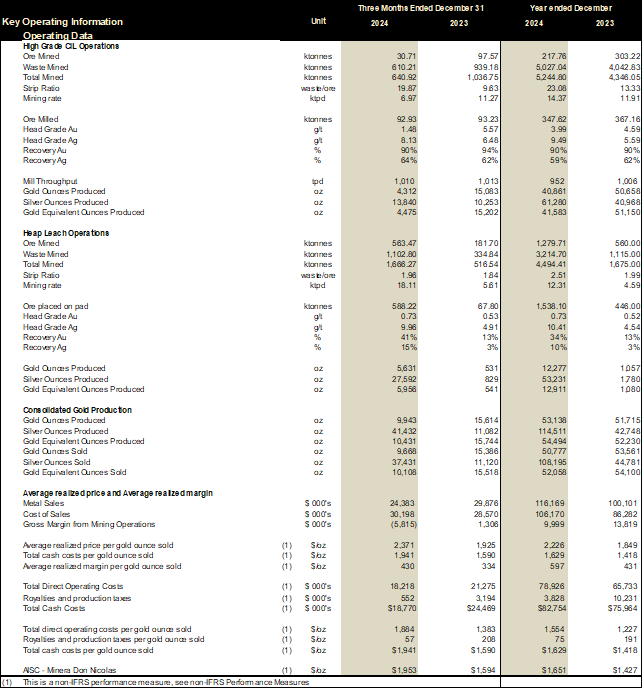

Cerrado reported an annual production of 54,494 Gold Equivalent Ounces (GEO), aligning with its guidance. In the fourth quarter alone, the company produced 10,431 GEO, reflecting a strategic shift in operations. The adjusted EBITDA for Q4 stood at $4.5 million, with a total of $24.4 million for the year, excluding project sales proceeds from the sale of Monte Do Carmo.

The company also received significant asset sale and option payment proceeds, totaling $34 million in Q4 and $49 million for the full year. This includes up to $25 million expected in the coming years, with $15 million guaranteed. These proceeds have played a crucial role in strengthening Cerrado’s balance sheet, with a remarkable $54.5 million improvement in its working capital position.

Operational Highlights

The operational results for Q4 revealed a decrease in production compared to the previous year, primarily due to the depletion of high-grade ore from the Calandrias Norte pit. As mining transitioned to heap leach production, the company focused on processing lower-grade stockpiles through the CIL plant. Despite these challenges, the heap leach operations showed promise, achieving production of 5,956 GEO during the quarter.

Cerrado’s All-In Sustaining Cost (AISC) rose to $1,953 in Q4, compared to $1,594 in Q4 2023. This increase was attributed to lower production levels and ongoing inflationary pressures in Argentina. However, the company remains optimistic about reducing costs as it ramps up production and replaces rental equipment.

Strategic Focus and Future Plans

Looking ahead, Cerrado aims to ramp up heap leach production to 4,000 – 4,500 GEO per month over the next four years. This goal is supported by a recent NI 43-101 Preliminary Economic Assessment Technical Report, which outlines a clear production profile for the MDN operation. The company is also set to initiate underground production at the Paloma site and complete a bankable feasibility study for the Mont Sorcier DRI iron project.

Mark Brennan, CEO and Chairman of Cerrado, emphasized the company’s commitment to maintaining production while reducing debt through increased cash flows. He stated, “We are well positioned to deploy capital in a strategic and fiscally prudent manner to ramp up exploration efforts at MDN.”

Financial Strength and Balance Sheet Improvement

Cerrado’s financial health has significantly improved over the past year. As of December 31, 2024, the company reported a working capital deficit of $12.9 million, a substantial decrease from $54.5 million in 2023. The cash and cash equivalents balance rose to $26.0 million, up from just $0.4 million the previous year. This improvement is largely due to reduced current debt payables and trade payables.

The company continues to focus on enhancing its balance sheet, with further improvements expected in Q1 and Q2 of 2025. The completion of the final $5 million payment for the MDN acquisition and repayments to royalty holders have contributed to this positive trend.

Upcoming Conference Call

Cerrado Gold’s management will host a conference call on May 1, 2025, at 11:00 AM EDT to discuss the Q4 and annual financial and operational results. Investors and stakeholders are encouraged to participate, with details available on the company’s investor page.

Conclusion

Cerrado Gold Inc. has navigated a challenging year with resilience and strategic foresight. With a solid production foundation, improved financial metrics, and ambitious plans for the future, the company is well-positioned for growth in 2025 and beyond. As it continues to optimize its operations and explore new opportunities, Cerrado remains a key player in the gold and iron production sectors in South America. For more information, visit Cerrado Gold’s website.