By Rick W., Contributor | Editor: Derek Curry

July 21, 2025, 01:25 AM ET

Follow Derek on LinkedIn

As investors navigate the complex landscape of the stock market, having a well-defined trading plan is essential. This article delves into the trading strategies for Eastern Platinum Limited (ELR:CA) as of July 21, 2025, providing insights into long-term investment plans and the current market sentiment surrounding this stock.

Long-Term Trading Plans

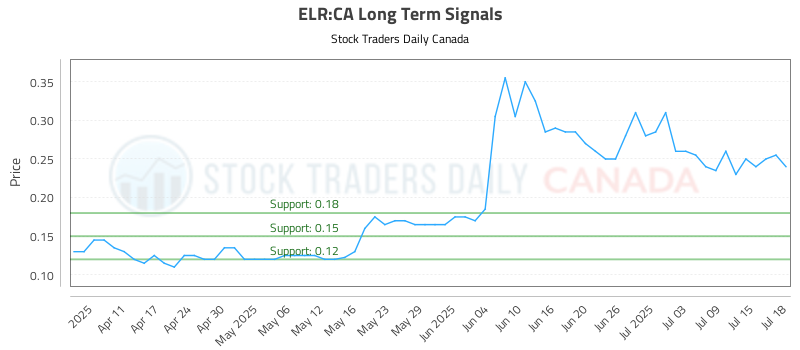

For those considering a long-term investment in Eastern Platinum Limited, the current recommendation is to buy near 0.18. This entry point is strategically chosen based on market analysis and historical performance.

Key Trading Parameters:

Target Price: Not applicable at this time, indicating a cautious approach to setting specific profit targets.

Stop Loss: Set at 0.18, which serves as a protective measure to limit potential losses. This stop-loss strategy is crucial for managing risk, especially in volatile markets.

No Short Plans Offered

At this juncture, there are no short-selling plans recommended for ELR:CA. This suggests a prevailing sentiment that the stock may not be positioned for a downward trend, making it less favorable for short-term traders looking to capitalize on declines.

Market Sentiment and Ratings

The current ratings for ELR:CA reflect a cautious outlook. As of July 21, the stock is rated as Weak across all terms—near, mid, and long. This assessment indicates that analysts are not optimistic about the stock’s performance in the immediate future.

Breakdown of Ratings:

Near Term: Weak

Mid Term: Weak

Long Term: Weak

These ratings suggest that investors should proceed with caution and consider the broader market conditions before making significant investments.

AI-Generated Signals

The integration of AI in stock analysis has become increasingly prevalent, providing traders with data-driven insights. For Eastern Platinum Limited, AI-generated signals are available, offering a comprehensive view of market trends and potential trading opportunities.

Accessing AI Signals

Investors can access updated AI-generated signals for Eastern Platinum Limited here. These signals can provide valuable information for making informed trading decisions, especially for those who rely on technology to guide their investment strategies.

Conclusion

In summary, the trading landscape for Eastern Platinum Limited (ELR:CA) as of July 21, 2025, presents a cautious outlook. With a recommendation to buy near 0.18 and a stop-loss strategy in place, long-term investors may find potential in this stock, albeit with a watchful eye on market conditions. The absence of short plans further emphasizes the current sentiment that the stock may stabilize or improve over time.

As always, investors should conduct their own research and consider their risk tolerance before making any trading decisions. The market is dynamic, and staying informed is key to successful investing.

For further insights and updates, be sure to check the latest AI-generated signals and market analyses. Happy trading!