August 09, 2025, 05:52 AM ET

By William C., Contributor | Editor: Derek Curry

Follow on LinkedIn

In the ever-evolving landscape of stock trading, having a well-structured trading plan is essential for both novice and seasoned investors. This article delves into the trading strategies for Platinum Group Metals Ltd. (PTM:CA), providing insights into long-term trading plans, current ratings, and AI-generated signals that can guide your investment decisions.

Long-Term Trading Plans

Buy Strategy

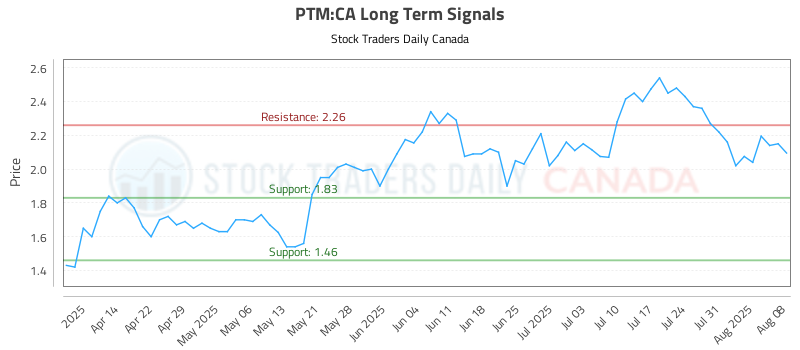

For investors looking to capitalize on potential upward movements in PTM:CA, the recommended buy strategy is to enter near the price of 1.83. This entry point is strategically chosen based on market analysis and historical price movements. The target for this trade is set at 2.26, which represents a significant upside potential. To mitigate risks, a stop-loss order is advised at 1.82. This stop-loss level is crucial as it helps protect your investment from unexpected downturns, ensuring that losses are minimized.

Short Strategy

Conversely, for those considering a short position, the strategy suggests entering near the price of 2.26. This level is identified as a potential resistance point, where the stock may struggle to maintain upward momentum. The target for this short trade is set at 1.83, aligning with the previous buy strategy’s entry point. A stop-loss order at 2.27 is recommended to safeguard against adverse price movements, allowing traders to exit the position if the market moves against them.

Current Ratings for PTM:CA

As of August 9, 2025, the ratings for PTM:CA are as follows:

Term

Near

Mid

Long

Rating

Strong

Neutral

Weak

These ratings provide a snapshot of market sentiment and can help investors gauge the stock’s potential performance over different time horizons. A “Strong” rating in the near term indicates bullish sentiment, while a “Weak” rating in the long term suggests caution.

AI-Generated Signals for PTM:CA

Incorporating technology into trading strategies can enhance decision-making processes. The AI-generated signals for PTM:CA offer valuable insights based on data analysis and predictive modeling. These signals can help traders identify optimal entry and exit points, making it easier to navigate the complexities of the stock market.

Chart Analysis

A visual representation of PTM:CA’s performance can be found in the accompanying chart. This chart illustrates historical price movements, trends, and potential support and resistance levels, providing a comprehensive view of the stock’s behavior over time. View the chart here.

Conclusion

In conclusion, trading Platinum Group Metals Ltd. (PTM:CA) requires a well-thought-out approach that combines strategic planning with real-time data analysis. By following the outlined trading plans, investors can position themselves to take advantage of market opportunities while managing risks effectively. As always, it is essential to stay informed and adapt to changing market conditions to maximize your trading success.

For more detailed insights and updates on PTM:CA, visit the Stock Traders Daily website.