Silver has once again captured the attention of investors, breaking through the significant $40-per-ounce resistance level for the first time since 2011. Since August 29, silver has gained over 5%, marking a notable resurgence in the precious metal’s market performance. But what factors are driving this latest bull run?

Follow the Leader: Silver’s Correlation with Gold

Silver’s recent rally can largely be attributed to its close relationship with gold. Over the past several days, gold has surged to record highs, eclipsing the $3,500 mark and pushing above $3,570 as of September 3. This upward momentum began after Federal Reserve Chairman Jerome Powell delivered a dovish speech at the Jackson Hole Economic Symposium, hinting at a potential rate cut in September. Powell acknowledged that downside employment risks “may warrant adjusting our policy stance” from its current restrictive setting.

Lower interest rates are generally considered bullish for precious metals like silver and gold, as they are non-yielding assets. A lower rate environment reduces the opportunity cost of holding these metals, making them more attractive to investors. Additionally, recent geopolitical events, including a federal judge ruling that many of President Trump’s tariffs were unconstitutional, have created a climate of uncertainty, prompting a flight to safe-haven assets.

Tight Silver Supply: A Fundamental Boost

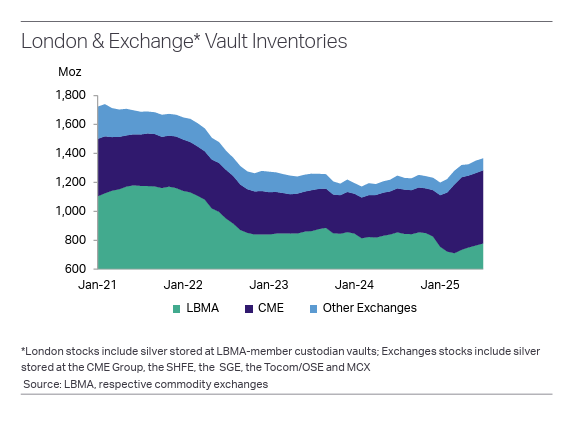

Beyond market sentiment, fundamental factors are also playing a crucial role in silver’s price surge. The supply of silver has tightened significantly, particularly due to a decline in liquidity in the London market. This trend began last summer when tariff concerns drove a considerable amount of silver out of London and into the U.S. Although silver was confirmed as tariff-exempt in April, lingering trade uncertainties have limited its return to London.

The silver market has been experiencing a structural deficit, with demand outstripping supply for the fourth consecutive year in 2024. According to Metals Focus, this deficit reached 148.9 million ounces, contributing to a four-year market shortfall of 678 million ounces—equivalent to ten months of mining supply. As industrial users scramble to secure existing stocks, prices are inevitably pushed higher.

Moreover, strong demand for physical silver in countries like India has exacerbated the drawdown in silver stocks. Despite record-high prices in rupee terms, demand for silver jewelry and investment remains robust, especially as the country approaches its wedding and festival season.

U.S. Investors on the Sidelines: Untapped Potential

While silver supplies continue to tighten, there remains a significant amount of untapped demand in the marketplace, particularly among U.S. investors. Despite rising prices, investor activity has been subdued, especially in key sectors like futures trading. Both the CME and the Shanghai Futures Exchange have reported declines in the number of silver futures contracts, and CFTC data shows that net managed money longs were about one-third below June’s highs.

This decline in investor positioning can be attributed to heightened macroeconomic and geopolitical uncertainties throughout the year, which have diverted attention toward gold. In the physical market, sales of silver coins and bars have also shrunk, primarily driven by a lack of interest from American investors. In contrast, demand from Asia, particularly India, remains strong, while European demand shows signs of recovery.

Interestingly, many U.S. investors have opted to sell their holdings to capitalize on higher prices, mirroring trends seen in the gold market. According to the Silver Institute, retail silver investment in the U.S. has decreased by about 30% this year. However, experts believe that once U.S. investors re-enter the market, it could drive silver prices even higher.

Looking Ahead: A Bullish Outlook for Silver

Industry experts remain optimistic about silver’s future. Money Metals CEO Stefan Gleason recently highlighted $40 as a critical level, suggesting that with gold prices at record levels, silver will become increasingly attractive. He predicts that even if silver reaches $45, $50, or $55, it will gain momentum and could challenge the $50 level by next year.

Metals Focus also shares a bullish outlook, stating that the factors constraining liquidity in the London market are likely to persist in the short term, providing ongoing price support. The investment case for silver—and gold—is expected to remain compelling well into 2026. Anticipated interest rate cuts by the Fed should further reduce the opportunity cost of holding precious metals, while global economic slowdowns and rising concerns about U.S. debt levels will likely support both gold and silver.

Conclusion

Silver’s recent rally past the $40 mark is a multifaceted phenomenon driven by a combination of market sentiment, fundamental supply constraints, and geopolitical uncertainties. As the landscape continues to evolve, both investors and analysts will be watching closely to see how these dynamics unfold in the coming months. With significant untapped demand in the U.S. and strong international interest, silver may well be on the brink of a sustained upward trajectory.