November 23, 2025, 03:47 AM ET

By Jolene W., Contributor | Editor: Derek Curry

Follow on LinkedIn

In the ever-evolving landscape of stock trading, having a well-defined trading plan is crucial for both novice and seasoned investors. This article delves into the trading strategies for Discovery Silver Corp. (DSV:CA), providing insights into long-term trading plans, AI-generated signals, and current market ratings.

Understanding the Trading Plans

Long-Term Buy Strategy

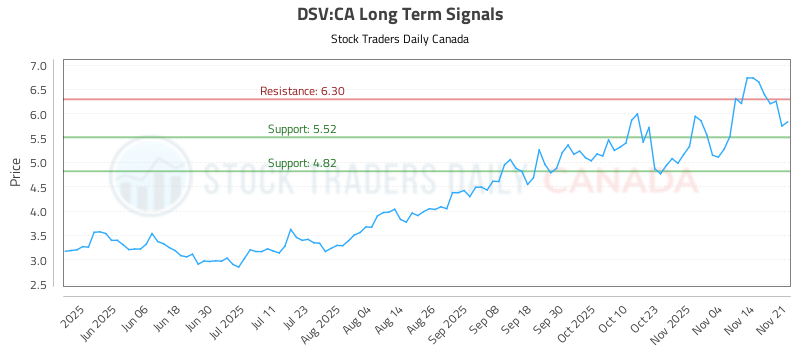

For investors looking to capitalize on potential gains, the recommended buy strategy for DSV:CA suggests entering the market near the price of 5.52. This entry point is strategically chosen to maximize upside potential while minimizing risk. The target price for this trade is set at 6.30, indicating a favorable risk-to-reward ratio. To safeguard against unforeseen market fluctuations, a stop loss is advised at 5.49, ensuring that losses are contained should the market move against the position.

Short-Term Sell Strategy

Conversely, for those looking to take advantage of potential downturns, a short position near 6.30 is recommended. The target for this trade is the previously mentioned buy price of 5.52, which reflects a strategic approach to capitalizing on market corrections. A stop loss is set at 6.33 to mitigate risk, allowing traders to exit the position if the market moves unfavorably.

AI-Generated Signals: A Modern Approach

The trading signals for DSV:CA are updated regularly, leveraging advanced AI technology to provide real-time insights. These signals are particularly valuable for traders who rely on data-driven strategies to make informed decisions. The latest AI-generated signals for Discovery Silver Corp. can be accessed here.

Current Market Ratings for DSV:CA

As of November 23, the ratings for DSV:CA are as follows:

Term

Near

Mid

Long

Rating

Weak

Strong

Strong

Analysis of Ratings

Near Term: The weak rating suggests caution for short-term traders, indicating potential volatility or unfavorable market conditions.

Mid Term: A strong rating reflects confidence in the stock’s performance over the next few months, suggesting that market conditions may improve.

Long Term: The strong long-term rating indicates a positive outlook for DSV:CA, making it an attractive option for investors with a longer investment horizon.

Conclusion

In summary, the trading plans for Discovery Silver Corp. (DSV:CA) offer a balanced approach for both long-term investors and short-term traders. By employing well-defined entry and exit strategies, traders can navigate the complexities of the market with greater confidence. The integration of AI-generated signals further enhances decision-making, providing valuable insights into market trends.

For those interested in exploring more about DSV:CA and its trading signals, further information is available here. As always, investors should conduct their own research and consider their risk tolerance before making any trading decisions.