December 12, 2025, 12:47 AM ET

By Allen K., Contributor | Editor: Derek Curry

Follow on LinkedIn

In the ever-evolving landscape of investment opportunities, the Sprott Physical Platinum and Palladium Trust (SPPP:CA) stands out as a unique asset for traders and investors alike. This article delves into the current trading plans, market ratings, and AI-generated signals for SPPP:CA, providing a comprehensive overview for those interested in long-term investment strategies.

Trading Plans (Long Term)

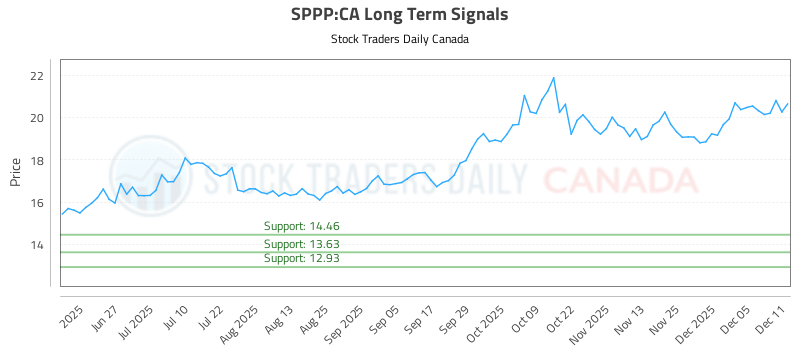

As of December 12, 2025, the trading plan for SPPP:CA is straightforward yet strategic. The recommendation is to buy near 14.46, with a stop loss set at 14.39. This approach allows investors to enter the market with a clear exit strategy, minimizing potential losses while positioning themselves for future gains.

No Short Plans Offered

At this time, there are no short plans available for SPPP:CA. This indicates a bullish sentiment among analysts, suggesting that the current market conditions favor long positions rather than short-selling strategies. Investors should remain vigilant, as market dynamics can shift rapidly, necessitating adjustments to trading plans.

Market Ratings for December 12

Understanding market sentiment is crucial for making informed investment decisions. The ratings for SPPP:CA on December 12 are as follows:

Near Term: Strong

Mid Term: Weak

Long Term: Neutral

Analyzing the Ratings

Near Term (Strong): The strong rating in the near term suggests that immediate market conditions are favorable for SPPP:CA. This could be attributed to recent price movements, investor interest, or broader market trends that positively impact platinum and palladium.

Mid Term (Weak): A weak rating in the mid-term indicates potential challenges ahead. Investors should be cautious and consider external factors that may affect the trust’s performance, such as economic indicators, geopolitical events, or changes in commodity prices.

Long Term (Neutral): A neutral long-term rating suggests stability but not necessarily growth. Investors should keep an eye on market developments and be prepared to adjust their strategies as new information becomes available.

AI-Generated Signals for SPPP:CA

The integration of artificial intelligence in trading strategies has revolutionized how investors approach the market. AI-generated signals for SPPP:CA provide valuable insights based on complex algorithms and data analysis.

Chart Analysis

While specific charts are not included in this article, they play a crucial role in visualizing price trends and potential entry and exit points. Investors are encouraged to utilize charting tools to analyze historical performance and identify patterns that may inform their trading decisions.

For those interested in accessing the latest AI-generated signals and detailed charts for SPPP:CA, they can be found here.

Conclusion

The Sprott Physical Platinum and Palladium Trust (SPPP:CA) presents a compelling opportunity for long-term investors, particularly with the current buy recommendation and strong near-term rating. However, the weak mid-term outlook and neutral long-term rating serve as a reminder to remain vigilant and adaptable in an ever-changing market.

As always, investors should conduct their own research and consider their risk tolerance before making investment decisions. The landscape of trading is complex, but with the right information and strategies, it can also be rewarding.

For ongoing updates and insights, be sure to check the timestamp on this data and stay informed about the latest developments in the market.