By Momei, Contributor, Stock Traders Daily | Editor: Derek Curry

December 19, 2025, 03:43 AM ET

Follow on LinkedIn

As we delve into the trading landscape for Eastern Platinum Limited (ELR:CA) on December 19, 2025, it’s essential to analyze the current market signals and trading strategies that can guide investors. This article will provide a comprehensive overview of the trading plans, ratings, and AI-generated signals for ELR:CA, ensuring that traders are well-equipped to make informed decisions.

Trading Plans (Long Term)

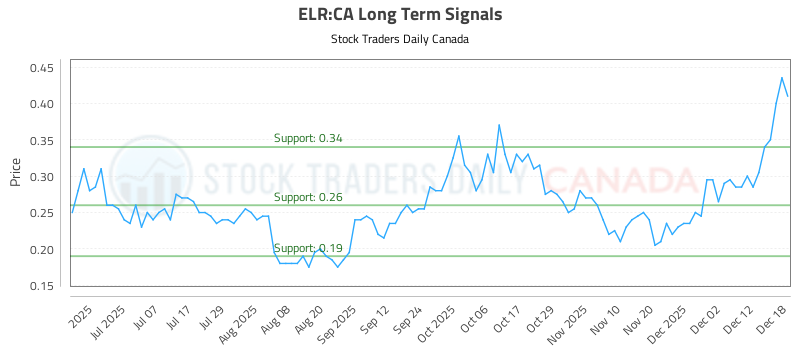

For long-term investors, the current recommendation is straightforward: Buy near 0.34, with a stop loss set at the same level of 0.34. This strategy indicates a cautious yet optimistic approach, allowing traders to enter the market while minimizing potential losses.

Key Considerations

Target Price: At this time, no specific target price has been provided. This suggests a focus on monitoring market conditions and adjusting strategies as necessary.

No Short Plans: Currently, there are no short selling plans offered. This could indicate a bullish sentiment surrounding ELR:CA, as traders are encouraged to focus on long positions rather than betting against the stock.

Market Sentiment and Ratings

Understanding market sentiment is crucial for any trading strategy. The ratings for ELR:CA on December 19 are as follows:

Term

Near

Mid

Long

Rating

Weak

Strong

Strong

Analysis of Ratings

Near Term: The weak rating suggests caution in the short term, possibly due to market volatility or external economic factors.

Mid and Long Term: The strong ratings for both mid and long-term perspectives indicate a positive outlook for ELR:CA, suggesting that investors may find value in holding the stock over a more extended period.

AI-Generated Signals for ELR:CA

The integration of AI in trading strategies has become increasingly prevalent, providing traders with data-driven insights. The AI-generated signals for ELR:CA are designed to enhance decision-making processes by analyzing vast amounts of market data.

Chart Analysis

While a specific chart for Eastern Platinum Limited is referenced, it is essential for traders to utilize these visual tools to identify trends, support and resistance levels, and potential entry and exit points. Charts can provide a clearer picture of price movements and help traders align their strategies with market conditions.

Conclusion

In summary, the trading plans for Eastern Platinum Limited (ELR:CA) on December 19, 2025, emphasize a cautious yet optimistic approach for long-term investors. With a buy recommendation near 0.34 and strong ratings for mid and long-term perspectives, traders are encouraged to stay informed and adaptable.

For those interested in the latest AI-generated signals and further insights, additional resources can be found here. As always, it is crucial to conduct thorough research and consider personal risk tolerance before making investment decisions.

By staying informed and utilizing strategic trading plans, investors can navigate the complexities of the stock market with greater confidence.