January 17, 2026, 05:02 PM ET

By Allen K., Contributor | Editor: Derek Curry

Follow on LinkedIn

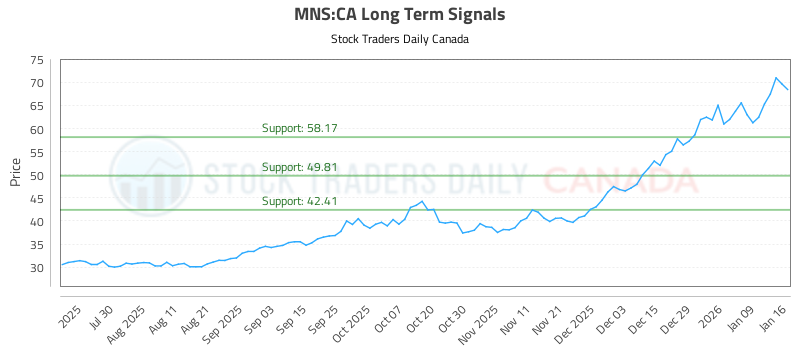

In the ever-evolving landscape of financial markets, having a well-structured trading plan is essential for both novice and seasoned investors. This article delves into the long-term trading plans for the Royal Canadian Mint – Canadian Silver Reserves Exchange-Traded Receipts (MNS:CA), providing insights into current strategies, market ratings, and AI-generated signals.

Current Trading Strategy

Buy Recommendations

For those looking to invest in MNS:CA, the current recommendation is to buy near the price of 58.17. This entry point is strategically chosen based on market analysis and historical performance. The rationale behind this recommendation is to capitalize on potential upward momentum while minimizing risk.

Stop Loss Considerations

To safeguard investments, a stop loss is set at 57.88. This measure is crucial for protecting capital in the event of unforeseen market fluctuations. By implementing a stop loss, investors can limit their potential losses and maintain a disciplined approach to trading.

Absence of Short Plans

At this time, no short selling plans are offered for MNS:CA. This indicates a bullish sentiment in the market, suggesting that the potential for upward movement outweighs the risks associated with shorting the stock. Investors are encouraged to focus on long positions as the market outlook remains positive.

Market Ratings for MNS:CA

January 17 Ratings Overview

The ratings for MNS:CA as of January 17 are as follows:

Near Term: Strong

Mid Term: Strong

Long Term: Strong

These ratings reflect a robust outlook for the stock across various time frames, indicating confidence in its performance. Investors should consider these ratings when making decisions, as they provide a comprehensive view of market sentiment.

AI-Generated Signals

Chart Analysis

The AI-generated signals for MNS:CA offer valuable insights into market trends and potential price movements. The accompanying chart provides a visual representation of historical data, helping investors identify patterns and make informed decisions.

For those interested in a deeper analysis, the chart can be accessed here. This resource is particularly beneficial for traders looking to refine their strategies based on data-driven insights.

Conclusion

In summary, the trading plans for MNS:CA emphasize a long-term bullish outlook, with clear buy recommendations and protective stop loss measures. The strong ratings across all time frames further reinforce the positive sentiment surrounding this investment. As always, investors should conduct their own research and consider their risk tolerance before making trading decisions.

For ongoing updates and AI-generated signals, be sure to check the latest information available here. Staying informed is key to navigating the complexities of the stock market successfully.