Comprehensive Analysis of GoldMining Inc. (GOLD:CA)

GoldMining Inc. (TSX: GOLD) is a Canadian-based precious metals exploration company focused on the acquisition, exploration, and development of gold-bearing properties in the Americas. This article provides an in-depth analysis of GOLD:CA, examining its recent performance, trading strategies, and market outlook.

Company Overview

GoldMining Inc. is dedicated to building a leading gold acquisition and development company throughout the Americas. The company holds a diversified portfolio of gold and gold-copper projects in the United States, Canada, Brazil, Colombia, and Peru. Its strategy involves acquiring and advancing gold projects with a focus on resource expansion and development.

Recent Performance and Trading Signals

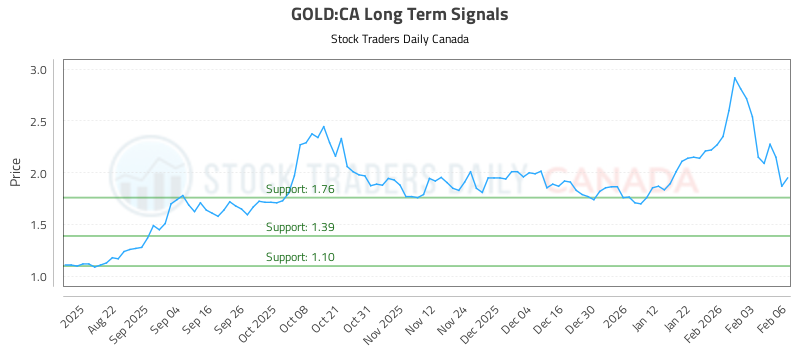

As of February 3, 2026, Stock Traders Daily provided the following trading plan for GOLD:CA:

Buy near: $1.76

Stop loss: $1.75

No short plans offered at this time

The ratings for GOLD:CA were as follows:

Near-term: Weak

Mid-term: Strong

Long-term: Neutral

These insights suggest a cautious approach in the near term, with potential for strength in the mid-term. (news.stocktradersdaily.com)

Technical Analysis

Technical analysis involves evaluating historical price movements and trading volumes to forecast future price trends. For GOLD:CA, recent analyses have identified key support and resistance levels:

Support Level: $1.39

Resistance Level: $1.76

Traders are advised to monitor these levels closely, as they can indicate potential entry and exit points. (news.stocktradersdaily.com)

Investment Considerations

Investing in gold mining companies like GoldMining Inc. offers exposure to the gold market, which can serve as a hedge against inflation and currency fluctuations. However, it’s essential to consider factors such as:

Commodity Price Volatility: Gold prices can be unpredictable, influenced by global economic conditions and geopolitical events.

Operational Risks: Mining operations are subject to environmental regulations, labor issues, and technical challenges.

Market Liquidity: As a smaller-cap company, GOLD:CA may experience lower trading volumes, potentially leading to higher volatility.

Conclusion

GoldMining Inc. presents a compelling opportunity for investors seeking exposure to the gold sector. While recent analyses indicate potential strength in the mid-term, it’s crucial to conduct thorough due diligence and consider personal investment objectives and risk tolerance. Staying informed through reputable sources and consulting with financial advisors can aid in making well-informed investment decisions.

Please note that investing in the stock market involves risks, and past performance is not indicative of future results. Always consult with a financial advisor before making investment decisions.