Toronto, Ontario—(Newsfile Corp. – August 22, 2025) — Kuya Silver Corporation (CSE: KUYA) (OTCQB: KUYAF) (FSE: 6MR1) has recently announced its financial and operational results for the second quarter of 2025, showcasing significant advancements at the Bethania Silver Project in Peru. This quarter has been marked by a remarkable ramp-up in mining output, substantial underground development, and promising exploration results, positioning Kuya Silver for a robust future.

Q2 2025 Highlights

Mining Ramp-Up

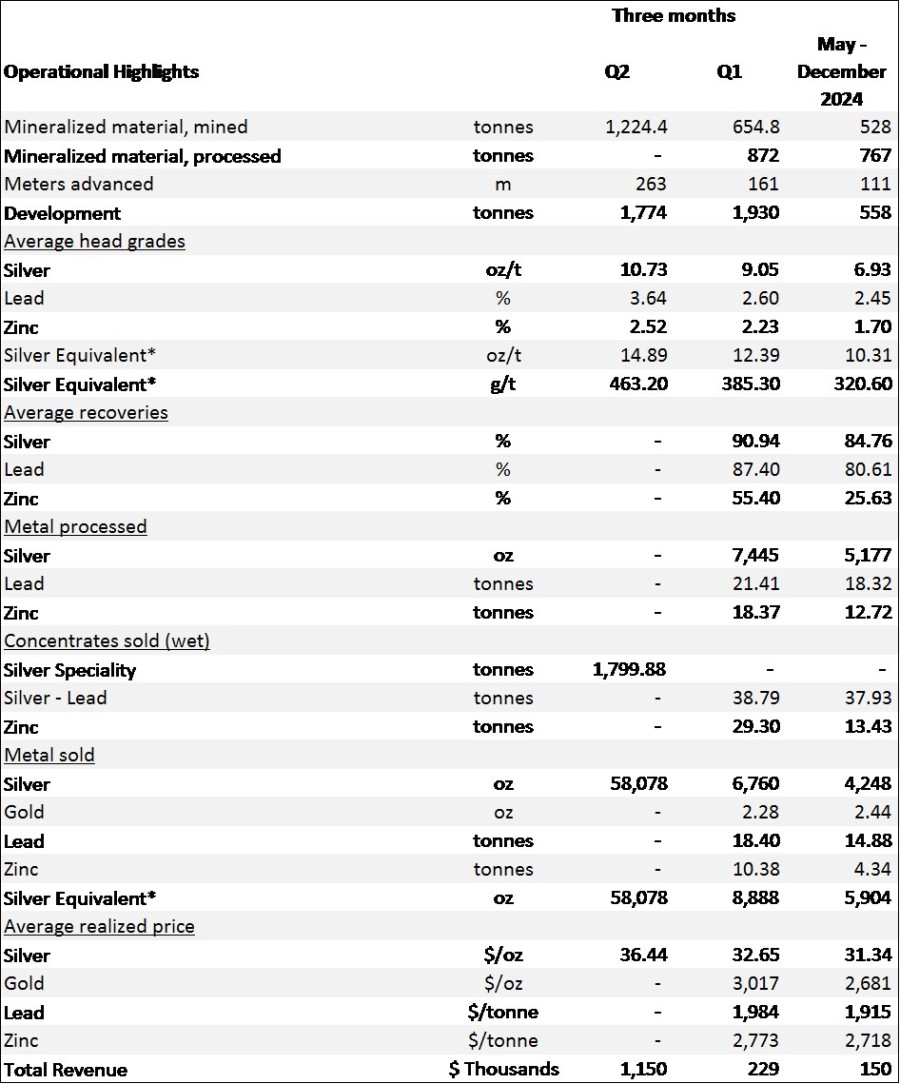

In Q2 2025, Kuya Silver achieved a notable increase in mining output, extracting 1,224 tonnes of mineralized material—nearly double the output from Q1. The average silver grades reached 10.73 oz/t, with silver equivalent grades at 14.89 oz/t. This impressive performance underscores the company’s commitment to enhancing operational efficiency and maximizing resource extraction.

Underground Development

The company made significant strides in underground development, completing approximately 263 metres of new development in Q2. This expansion allowed access to ten active working faces by the end of the quarter, a substantial increase from six in Q1. Such advancements are crucial for sustaining higher mining rates and supporting the overall ramp-up strategy.

Infrastructure Upgrades

To bolster operational efficiency and safety, Kuya Silver completed several infrastructure upgrades, including the installation of trailing winches, a high-capacity compressor, and a new generator. These enhancements are expected to improve the reliability of underground operations, setting the stage for increased throughput in the coming quarters.

Exploration Success

Exploration efforts yielded exciting results, with the discovery of three new silver-rich vein systems in historical artisanal mining zones. Notably, 12 samples exceeded 1,000 g/t silver equivalent, with one sample reaching an impressive 2,668 g/t silver equivalent. New targets were identified at Millococha Oeste, Millococha Norte, and Carmelitas Este, expanding the mineralized strike length by 41% in the Bethania district.

Financial Performance

Kuya Silver reported a net revenue of $0.70 million in Q2 2025, a significant increase from nil revenue in the same quarter last year. The net loss decreased to $0.28 million, down from $1.45 million in Q2 2024, reflecting improved operational performance and financial management.

Strengthened Balance Sheet

The company raised over CAD $10.8 million through equity financings in the first half of 2025, providing essential capital for accelerated development at Bethania and regional exploration programs. This financial boost positions Kuya Silver for sustained growth and operational success.

Leadership Enhancements

In a move to strengthen governance, Kuya Silver appointed three independent directors with extensive experience in capital markets and mining. Additionally, Sheila Magallon was appointed as CFO, bringing over 20 years of financial leadership experience in the mining sector.

Operational Results

Bethania Silver Project

At the Bethania Silver Project, Kuya Silver achieved a remarkable 87% increase in mining output compared to the previous quarter. The development work advanced by 63%, providing the necessary working faces to sustain higher mining rates. Although toll milling availability caused a temporary pause in processing, the company stockpiled mineralized material, and milling operations resumed in July, ensuring consistent production for the second half of the year.

Silver Kings Project

In Canada, the Silver Kings Project contributed 1,800 wet tonnes of silver concentrate shipped in Q2, generating USD $1.15 million in revenue. This successful marketing of stockpiled concentrate highlights the strategic importance of the Silver Kings project in Kuya Silver’s portfolio.

Exploration Overview

Bethania District

During Q2 2025, Kuya Silver expanded its field exploration program, identifying new high-grade vein zones at Millococha Oeste and Millococha Norte. Grab samples returned values up to 2,630 g/t Ag, contributing to a 40-41% increase in the combined mineralized strike length of silver-mineralized veins, now totaling nearly 7 kilometers across the property.

Silver Kings Project

Final results from the 2024-2025 drilling program at the Silver Kings Project revealed multiple mineralized ladder veins and a new vein cluster, expanding the mineralized zone at depth. This promising development opens up further exploration opportunities and enhances the project’s potential.

Financial Highlights

Kuya Silver generated approximately $0.70 million in revenue during Q2 2025, primarily from concentrate sales. The company recorded a net loss of $282,559, a significant improvement from a loss of $1,631,545 in Q2 2024. Year-to-date, Kuya reported approximately $0.92 million in net revenue compared to nil in the first half of 2024.

Corporate Overview

Kuya Silver has made significant strides in strengthening its financial position and governance. The company completed three tranches of a non-brokered private placement, issuing 11.6 million common shares for gross proceeds of approximately CAD $2.9 million. An additional financing in August raised CAD $9.1 million, bolstering the company’s balance sheet for future growth.

Outlook

Looking ahead, Kuya Silver remains focused on advancing the Bethania Silver Project, with plans to achieve an initial production milestone of 100 tonnes per day by Q3 2025. As production ramps up, the company anticipates a reduction in unit costs and an increase in revenue, paving the way for stronger operating cash flow. Long-term, Kuya Silver aims to expand Bethania toward a phase 1 target production rate of 350 tonnes per day, supported by ongoing development and exploration.

Conclusion

Kuya Silver Corporation is poised for significant growth as it continues to enhance its operations at the Bethania Silver Project and explore new opportunities in the region. With a strengthened balance sheet, improved operational efficiency, and promising exploration results, the company is well-positioned to capitalize on the growing demand for silver in the global market.

Reader Advisory: This article contains forward-looking statements regarding Kuya Silver Corporation’s plans and expectations. Investors are cautioned that such statements involve risks and uncertainties, and actual results may differ materially. For more information, please refer to the company’s filings on SEDAR+.

About Kuya Silver Corporation: Kuya Silver is a Canadian-based, growth-oriented mining company focused on silver, operating the Bethania silver mine in Peru while developing district-scale silver projects in mining-friendly jurisdictions.