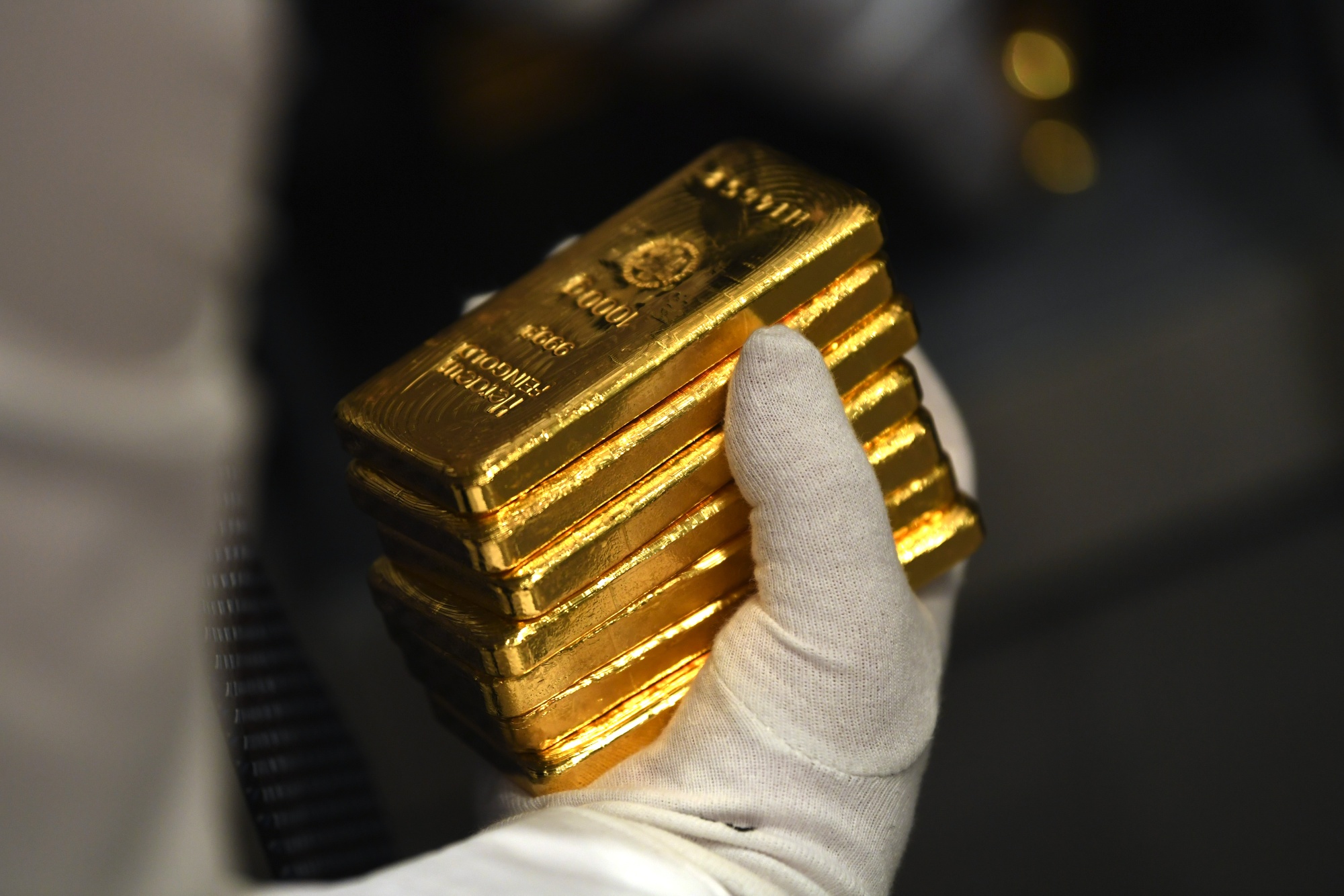

As of April 14, 2025, the gold rates in the United Arab Emirates (UAE) are as follows:

24K Gold: AED 389.00

22K Gold: AED 360.25

21K Gold: AED 345.25

18K Gold: AED 296.00

The gold market in the UAE is not just a reflection of local demand but also a significant indicator of global economic trends. With its strategic location and robust trading infrastructure, the UAE has become a pivotal hub for gold transactions, attracting buyers and investors from around the world.

The UAE’s Gold Market: A Global Player

The United Arab Emirates has established itself as a key player in the global gold trade, with gold imports constituting over a third of its total imports. This remarkable statistic underscores the importance of gold in the UAE’s economy. In 2019 alone, gold imports reached a staggering $20 billion, showcasing a significant increase from previous years. The primary markets for the UAE’s gold trade include major economies such as India, Switzerland, and the USA, highlighting the interconnectedness of global markets.

Supply and Demand Dynamics

The demand for gold in the UAE is predominantly driven by consumer purchases of jewelry, which account for nearly half of all gold transactions. The cultural significance of gold in the region, particularly in weddings and celebrations, fuels this demand. Additionally, institutional investors and banks play a crucial role in the gold market, often acquiring large quantities during times of economic uncertainty or when favorable profit opportunities arise.

While the UAE does have some domestic gold production, it heavily relies on imports to meet its supply needs. The majority of gold is sourced from Africa and Europe, ensuring that the UAE remains well-stocked to satisfy both consumer and investment demands.

Future Trajectories of the Gold Market

As we look to the future, the UAE’s gold market is poised to navigate a complex landscape shaped by various geopolitical and economic factors. Fluctuations in oil prices, a key driver of the UAE’s economy, could significantly impact gold demand. Furthermore, concerns regarding global economic growth may lead to shifts in investment patterns, with gold often seen as a safe haven during turbulent times.

Another emerging trend is the transition from physical gold to digital investments. As technology evolves, more investors are exploring options such as gold-backed cryptocurrencies and digital gold trading platforms. This shift may present challenges for traditional gold markets, including the UAE’s, but it also opens up new avenues for growth and innovation.

Despite these challenges, the UAE’s gold market benefits from a robust infrastructure, supportive governmental policies, and active participation in international trade initiatives. These factors contribute to a promising outlook for the UAE’s continued dominance in the gold industry.

Understanding Carats/Karats

A crucial aspect of the gold market is the measurement of gold purity, which is denoted in carats or karats (symbol/abbreviation K). Pure gold is classified as 24K, but due to its malleability and softness, it is often alloyed with other metals to enhance its durability. Here’s a breakdown of common gold alloys:

24K: Pure gold (99.9% gold content).

22K: Contains 22 parts pure gold and two parts other metals, with a gold percentage of 91.7%.

21K: Comprises 21 parts pure gold and three parts other metals, with a gold percentage of 87.5%.

18K: Made up of 18 parts pure gold and six parts other metals, with a gold percentage of 75%.

14K: Consists of 14 parts pure gold and ten parts other metals, with a gold percentage of 58.3%.

9K: Contains nine parts pure gold and 15 parts other metals, with a gold percentage of 37.5%.

Understanding these distinctions is essential for consumers and investors alike, as the purity of gold directly influences its value and suitability for various applications, particularly in jewelry.

Conclusion

The gold market in the UAE is a dynamic and integral part of the nation’s economy, reflecting both local cultural practices and global economic trends. As we move forward, the interplay of supply and demand, geopolitical factors, and technological advancements will shape the future of gold trading in the region. Whether for investment or personal adornment, gold remains a cherished asset, symbolizing wealth and stability in an ever-changing world.

For the latest updates on gold prices and market trends, stay informed through reliable news sources and financial platforms.