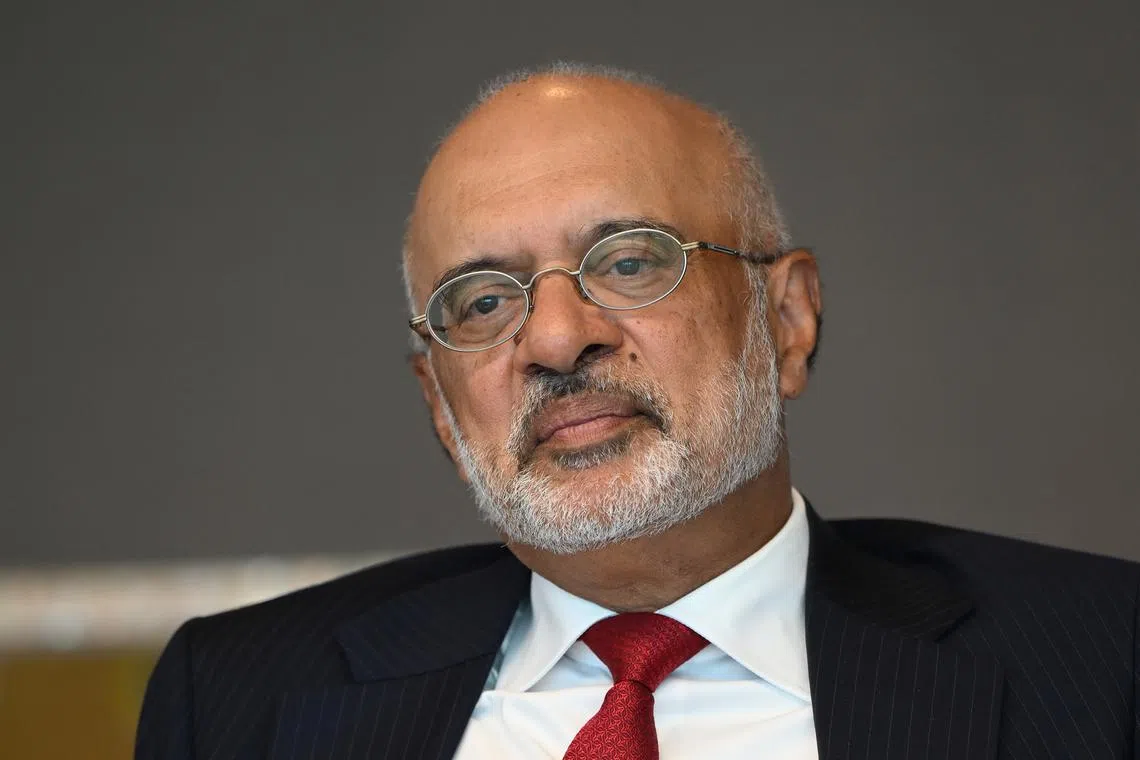

As Piyush Gupta prepares to step down as the chief executive officer of DBS Bank, his reflections on the global economy provide valuable insights for investors and market watchers alike. With a tenure marked by significant digital transformation and impressive growth, Gupta’s final address highlights both the strengths and potential pitfalls of the current economic landscape, particularly focusing on the United States as a pivotal player in global growth.

The US as a Growth Engine

In his recent remarks, Gupta emphasized that the United States continues to be a primary engine of global economic growth. Despite high inflation, he noted that retail sales remain robust, and job creation is on the rise. This resilience suggests that the US economy is navigating through challenges more effectively than many anticipated. Gupta’s perspective aligns with the notion of a “soft landing,” where the Federal Reserve successfully curbs inflation without triggering a recession.

However, he cautioned that while the market currently anticipates no further interest rate cuts from the Fed, he believes there will be at least a couple of cuts in the near future. This expectation could influence investment strategies, particularly in US equities, which Gupta suggests may still be worth considering despite their high valuations.

Potential Headwinds for the US Economy

While Gupta remains optimistic about the US economy, he also identified three significant headwinds that could lead to market corrections. The first is the potential instability in financial markets. Rising consumer loan delinquencies and an alarming increase in total household debt—now at a record high of nearly $18 trillion—pose risks to economic stability. Gupta pointed out that the availability of US dollars is shrinking, which could exacerbate these issues.

A stronger US dollar, while beneficial for some, creates challenges for emerging markets that face rising costs associated with external debt denominated in dollars. Gupta warned that these factors combined—delinquency rates, high valuations, and tighter liquidity—could lead to market corrections, creating a ripple effect that impacts the broader economy.

Trade Policies and Global Implications

Gupta also highlighted the risks associated with more extreme trade policies, particularly those that could adversely affect emerging markets and export-driven economies in Asia. He noted that slower growth in these regions would inevitably impact the US economy, creating a complex web of interdependencies that investors must navigate.

Additionally, the US government’s debt-to-GDP ratio, hovering around 120%, raises concerns about the sustainability of fiscal policies and the potential costs of servicing this debt. Gupta’s analysis suggests that while the US economy may perform well overall, volatility and uncertainty are likely to persist.

Regional Economic Outlook: Asia

Turning to Asia, Gupta’s insights on China reveal a landscape fraught with challenges. Despite various policy measures aimed at boosting growth, a fundamental lack of market confidence hampers progress. While some sectors may see improvements, others, such as the electric vehicle market, face potential value destruction due to oversaturation.

In India, growth is projected to slow to between 6% and 6.5% for the fiscal year ending March 2025, down from 8.2% the previous year. Meanwhile, Southeast Asia presents a mixed outlook. Singapore is expected to experience broad-based growth, with GDP growth forecasted between 1% and 3% in 2025. In contrast, Malaysia is projected to maintain a strong growth trajectory of at least 5%, driven by foreign investments, while Indonesia’s outlook remains uncertain.

Investment Strategies Moving Forward

As Gupta prepares to hand over the reins to deputy CEO Tan Su Shan, he leaves behind a legacy of innovation and growth. DBS Bank’s chief investment officer, Hou Wey Fook, has advocated for a diversified investment strategy, emphasizing the importance of being defensive in the current climate. He recommends an “overweight” position in US equities and technology stocks, driven by a pro-business environment and advancements in artificial intelligence.

Moreover, Hou suggests that investors consider fixed income for downside protection amid escalating trade tensions, alongside assets like gold and hedge funds to enhance portfolio resilience.

Conclusion

Piyush Gupta’s tenure at DBS Bank has been marked by transformative growth and a forward-thinking approach to banking. As he steps down, his insights into the global economy serve as a crucial guide for investors navigating a landscape filled with both opportunities and challenges. With the US continuing to play a central role in global growth, understanding the potential headwinds and regional dynamics will be essential for making informed investment decisions in the coming years.