Gold miners’ Q3 earnings season has just concluded, and the results from major players in the sector have been nothing short of spectacular. This performance is crucial for justifying the impressive bull run in gold stocks throughout the year. With gold prices soaring, miners are reaping substantial profits, achieving numerous all-time records. Their consistent profitability over the past couple of years suggests that significant future gains in gold stocks are still on the horizon.

The Dominance of GDX

The VanEck Gold Miners ETF (GDX) remains the benchmark for this sector. Launched in May 2006, GDX has leveraged its first-mover advantage to maintain a commanding lead, boasting $23.9 billion in net assets—over nine times larger than its nearest competitor. This ETF is the preferred trading vehicle for investors, with the largest gold miners making up the majority of its weighting.

Gold stocks are categorized based on their annual production rates. Small juniors produce under 300,000 ounces, mid-tier miners yield between 300,000 and 1,000,000 ounces, large majors exceed 1,000,000 ounces, and super-majors operate at scales exceeding 2,000,000 ounces. The two largest categories account for nearly 44% of GDX, highlighting the concentration of production among the biggest players.

A Stellar Year for GDX

As of midweek, GDX has skyrocketed 133.9% year-to-date, part of a larger bull run that has seen gains of 225.9% over the past 24 months. This remarkable performance has naturally attracted the attention of speculators and investors alike. Earlier this year, I discussed why 2025 is poised to be a pivotal year for gold stocks.

However, financial markets are rarely linear, and gold stocks are known for their volatility. Following an extraordinary peak in mid-October, gold stocks experienced a sharp decline, with GDX plunging 19.1% in just three weeks. Historical trends suggest that the recent drawdown may not be over, which could further impact gold stocks.

The Importance of Q3 Results

The Q3 results from major gold miners are particularly significant. Their operational and financial performance will influence stock prices moving forward. Strong fundamentals are essential to justify the substantial gains of 2025 and to support the ongoing bull run after gold’s healthy correction.

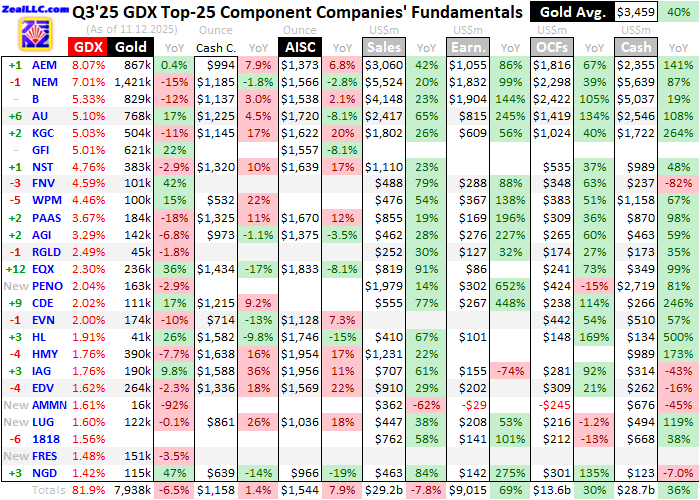

For 38 consecutive quarters, I have meticulously analyzed the operational and financial results of GDX’s 25 largest component stocks. These include super-majors, majors, and larger mid-tier miners, which collectively represent 81.9% of GDX’s total weighting. Understanding these fundamentals helps clarify the sentiment surrounding this sector.

Operational Highlights from Q3’25

The operational and financial highlights from the GDX top 25 during Q3’25 reveal significant insights. The production figures, year-over-year changes, and costs of extraction are critical metrics for assessing profitability. The average cash costs and all-in sustaining costs (AISCs) provide a clearer picture of miners’ profitability.

In Q3, the average gold price soared 39.7% year-over-year to a record $3,459 per ounce. This surge in gold prices translated into impressive results for major gold miners, who set numerous records in the process.

Shifting Dynamics in GDX

Historically, the upper ranks of GDX have remained stable, but recent changes have been surprising. The long-standing dominance of Newmont and Barrick Mining is waning, with Agnico Eagle Mines emerging as the new leader. Agnico’s production of 867,000 ounces in Q3 edged up 0.4% year-over-year, while Newmont and Barrick experienced significant production declines of 14.8% and 12.1%, respectively.

Agnico’s AISCs were also more favorable at $1,373 per ounce, compared to Newmont’s $1,566 and Barrick’s $1,538. This shift indicates a changing landscape in the gold mining sector, with Agnico proving to be a more efficient operator.

The Impact of Production and Costs

The GDX top 25 collectively produced 7,938,000 ounces of gold in Q3, a decline of 6.5% year-over-year. However, excluding the underperforming Zijin Mining, the remaining miners showed a slight production decline of only 1.6%. This suggests that the majority of GDX’s top miners are performing well, despite the challenges posed by Newmont and Barrick.

Unit gold-mining costs are generally inversely proportional to production levels. The average cash costs for the GDX top 25 edged up 1.4% year-over-year to $1,158 per ounce, while AISCs surged 7.9% to a record $1,544 per ounce. This increase reflects the rising costs associated with higher gold prices, which also boost royalty payments.

Record Earnings and Future Prospects

The implied unit earnings for the GDX top 25 reached an astounding $1,915 per ounce, marking an 83.1% year-over-year increase. This impressive growth trend has persisted over the last nine quarters, with earnings consistently rising. The current quarter is expected to continue this trend, with gold prices remaining high.

Despite the recent drawdown in gold prices, the fundamentals of gold miners remain strong. The GDX top 25 reported record revenues of $29.2 billion, with bottom-line profits soaring 68.7% year-over-year to $9 billion. These results indicate that gold miners are well-positioned for future growth.

Conclusion: A Bright Future for Gold Miners

The major gold miners dominating GDX have achieved their best quarter in history, driven by record gold prices and substantial profits. This marks the ninth consecutive quarter of rising per-ounce earnings, yet their stock prices remain relatively undervalued. As gold prices undergo necessary corrections, any significant pullbacks in stock prices could present excellent buying opportunities.

With the fundamentals supporting continued growth, investors should remain vigilant and ready to capitalize on favorable market conditions. The gold miners’ latest results suggest that the sector is poised for further gains, making it an attractive option for those looking to invest in a resilient market.

For those interested in staying informed about market trends and opportunities, subscribing to specialized newsletters can provide valuable insights and guidance. The gold mining sector is on the cusp of significant developments, and being well-informed can lead to successful investment strategies.