VANCOUVER, BC / ACCESSWIRE / November 22, 2024 – Guanajuato Silver Company Ltd. (GSilver) has announced its financial and operational results for the third quarter (Q3) and the nine-month period ending September 30, 2024. The report highlights a significant achievement for the company, marking its second consecutive quarter of positive adjusted EBITDA, amounting to US$892,277. This milestone underscores the company’s improving cash flow from mining operations, a promising sign for investors and stakeholders alike.

Financial Highlights

In Q3 2024, GSilver reported a positive mine operating income of $515,576, continuing the trend of profitability from mining operations established in the previous quarter. The company’s all-in sustaining cost (AISC) per silver-equivalent ounce was $23.88, reflecting a 7% improvement over the previous quarter. Additionally, the cash cost per silver-equivalent ounce was recorded at $18.78, marking a 6% reduction from the prior quarter.

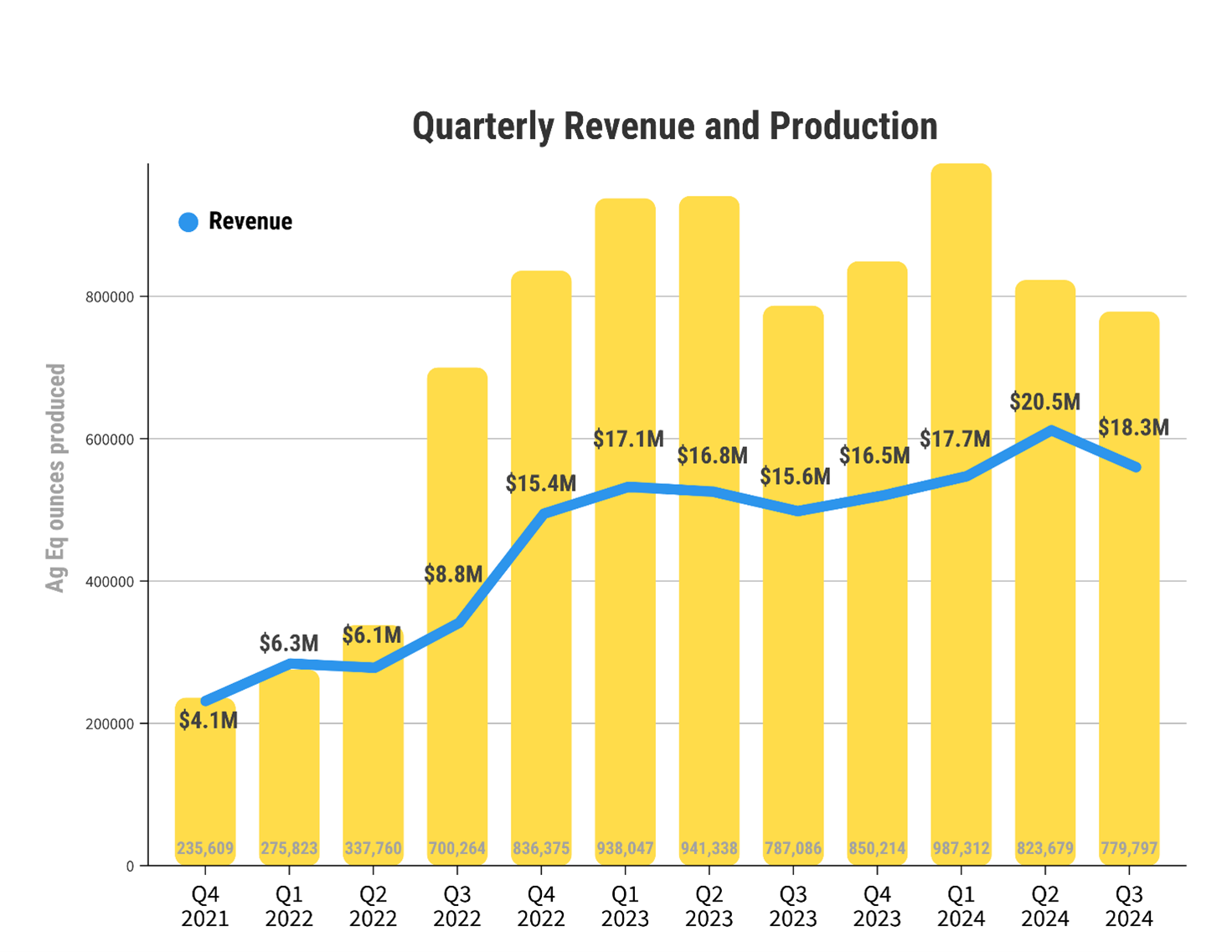

The production results for the quarter were robust, with a total of 779,797 silver-equivalent ounces produced. This included 413,607 ounces of silver, 3,617 ounces of gold, 806,945 pounds of lead, and 926,056 pounds of zinc. Notably, silver production accounted for 50% of Q3 revenue, while gold contributed 43%. The company’s revenue for the quarter reached $18.3 million, representing a 17% increase compared to Q3 2023, although it was an 11% decrease from the previous quarter.

Operational Efficiency and Production Milestones

GSilver has made significant capital investments over the past year aimed at enhancing operational efficiencies across its four producing silver mines: El Cubo, Valenciana, San Ignacio, and Topia. During the quarter, the company achieved a significant production milestone, surpassing 3 million silver-equivalent ounces produced at the El Cubo Mines Complex since operations resumed in late 2021.

Despite the positive production results, total tonnes milled decreased by 10% from the previous quarter, primarily due to maintenance requirements across the fleet and milling operations. The company undertook an enhanced maintenance program during the quarter, which is expected to continue into Q4, ensuring that operational efficiency remains a top priority.

Debt Repayment and Financial Position

A noteworthy development during the quarter was the complete repayment of a US$7.5 million silver and gold pre-payment facility to OCIM Metals & Mining S.A., following the earlier repayment of a US$5 million concentrate pre-payment facility owed to Ocean Partners UK Limited. These repayments reflect GSilver’s commitment to maintaining a healthy balance sheet and reducing financial liabilities.

As of September 30, 2024, GSilver reported cash and cash equivalents of $1.6 million, alongside a negative working capital of $20.4 million. However, the company successfully closed an equity financing on October 30, raising C$8.72 million, which is expected to bolster its financial position moving forward.

Looking Ahead

The positive adjusted EBITDA of $892,277 for the second consecutive quarter indicates that GSilver is on a path of recovery and growth. The company’s focus on improving operational efficiencies, coupled with strategic investments, positions it well for future success in the competitive silver mining sector.

As GSilver continues to navigate the complexities of the mining industry, it remains committed to enhancing its production capabilities while managing costs effectively. The company’s leadership is optimistic about the future, with plans to further capitalize on the growing demand for precious metals.

Conclusion

Guanajuato Silver Company Ltd. is demonstrating resilience and growth in a challenging market. With its recent financial results showcasing improved operational performance and strategic debt management, GSilver is poised to solidify its position as one of Mexico’s fastest-growing silver producers. Investors and stakeholders can look forward to continued developments as the company strives to enhance its production and financial health in the coming quarters.

For more information on Guanajuato Silver Company Ltd., please visit their official website or refer to their profile on SEDAR+ for detailed financial statements and management discussions.