Hycroft Mining, a prominent player in the mining sector, has recently made headlines with remarkable drilling results from its namesake project in Nevada. This article delves into the significant findings from Hycroft, alongside notable results from other mining companies, showcasing the ongoing exploration and potential in the silver market.

Exceptional Drilling Results at Hycroft

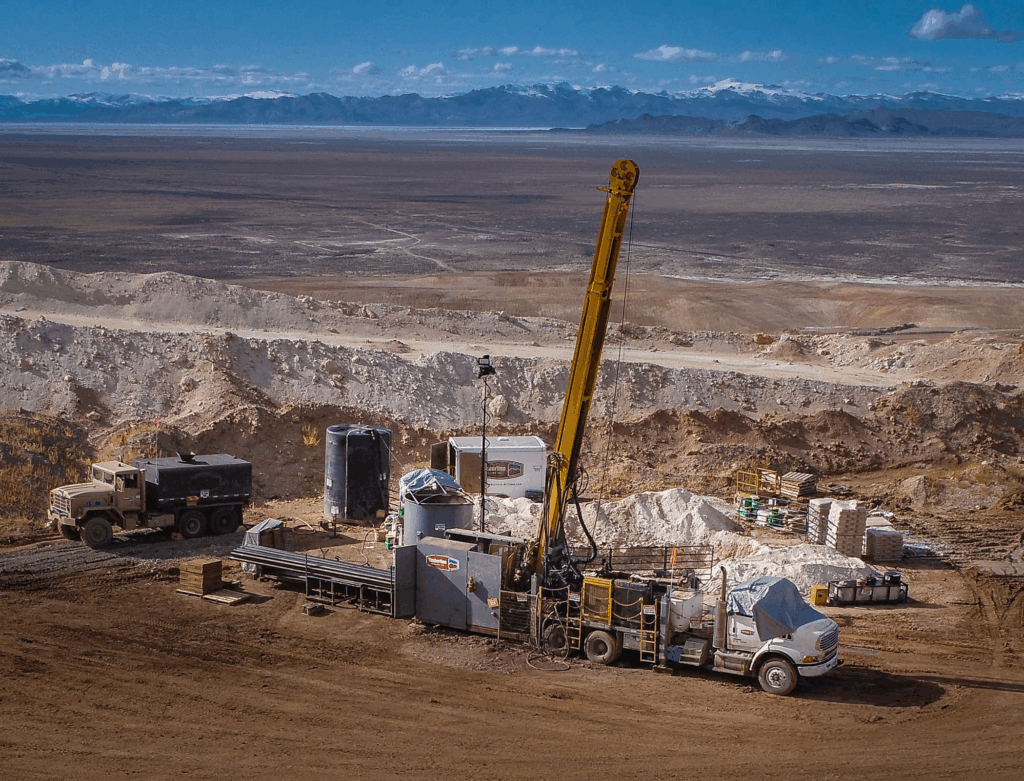

Hycroft Mining (Nasdaq: HYMC) has emerged as a leader in silver assays, particularly highlighted by its recent drilling results from the Hycroft project. The standout hole, H24D-6018, revealed an impressive 21.2 meters grading 2,359 grams of silver per tonne, starting from a depth of 306.6 meters. This translates to a remarkable grade times width value of 50,025, marking it as the best hole drilled at the site in over four decades.

Alex Davidson, Hycroft’s vice-president of exploration, emphasized the significance of this intersection, which pierced the Brimstone zone. The results confirm the continuity of a high-grade silver trend at Brimstone, located on the eastern side of the gold-silver pit in northwest Nevada. The site has a history of intermittent production from 1983 to 2021, when operations were halted due to rising costs.

Strategic Development Plans

In light of these promising results, Hycroft is contemplating the development of a smaller high-grade mine as an initial phase of sulphide mining. The company has been advancing metallurgical and engineering work throughout the first half of the year. Recently, Hycroft initiated a 14,500-meter drill program, employing two rigs to further explore and expand high-grade discoveries at both Brimstone and Vortex, located to the south.

The company aims to complete a comprehensive technical study, including economic assessments, by the fourth quarter of this year. According to a 2023 technical report, Hycroft hosts 819.1 million measured and indicated tonnes grading 0.4 grams of gold per tonne and 13.68 grams of silver, equating to approximately 10.58 million ounces of gold and 360.66 million ounces of silver.

Aftermath Silver: A Strong Contender

Following closely behind Hycroft is Aftermath Silver (TSX: SSRM), which reported impressive results from its Berenguela project in Peru. Hole AFD100 returned 156 meters grading 290 grams of silver per tonne from the surface, yielding a grade times width value of 45,240. This drilling was part of a 5,200-meter program aimed at defining the mineralization zone and converting inferred resources to indicated and measured categories.

Berenguela has a rich history, with mining activities occurring from 1913 to 1965, during which approximately 454,000 tonnes of ore were extracted. The current resource estimate indicates 40.17 million measured and indicated tonnes grading 78 grams of silver, amounting to 101.2 million contained ounces. Aftermath plans to complete a preliminary feasibility study for Berenguela this year, further solidifying its position in the silver market.

Aya Gold & Silver: Expanding Horizons

Aya Gold & Silver (TSX: AYA) also made waves with its drilling results from the Zgounder silver mine in Morocco. Hole ZG-RC-24-277 cut 17 meters grading 2,425 grams of silver from a depth of 33 meters, achieving a grade times width value of 41,225. This result, part of a larger exploration program, indicates the potential for increasing high-grade ounces in and around Zgounder’s pit.

Aya recently declared commercial production at Zgounder, which produced over 1.04 million ounces in the second quarter, with a target of 5 million to 5.3 million ounces for 2025. The mine currently hosts 8.5 million proven and probable reserves grading 257 grams of silver, with a post-tax net asset value of $373 million. Aya is actively pursuing further exploration, budgeting $25 million to $30 million for its ongoing projects.

Conclusion

The recent drilling results from Hycroft Mining, Aftermath Silver, and Aya Gold & Silver underscore the vibrant potential of the silver market. With significant discoveries and strategic development plans, these companies are poised to make substantial contributions to the mining industry. As exploration continues, the future of silver mining looks promising, with exciting opportunities on the horizon for investors and stakeholders alike.