Introduction

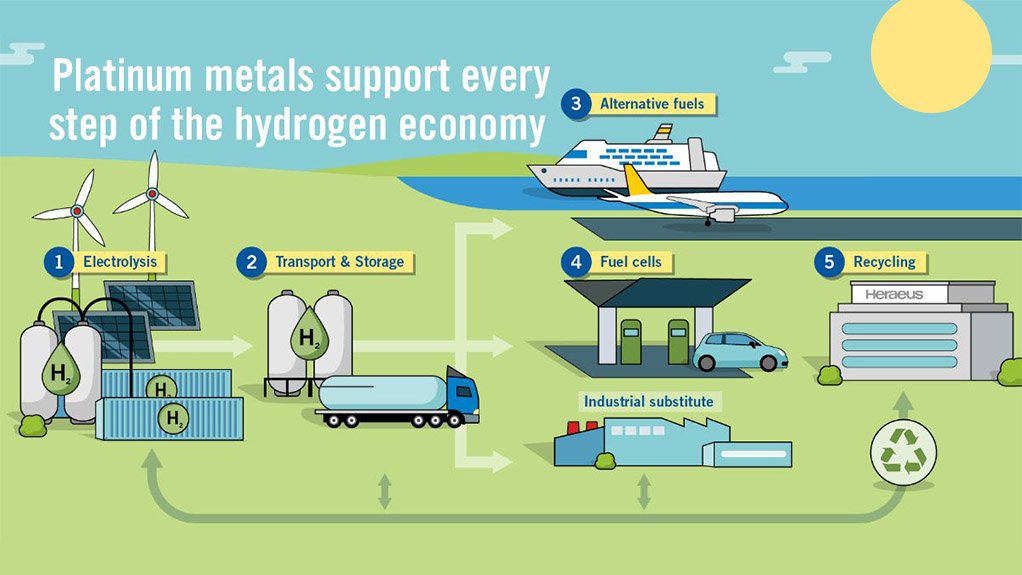

The global landscape for platinum group metals (PGMs) is undergoing a transformative shift, driven by the burgeoning demand for green hydrogen technologies and fuel cells. Recent developments across various sectors highlight the pivotal role PGMs will play in the transition to a sustainable energy future. This article explores the latest advancements in green hydrogen generation, the expanding applications of PGMs, and the implications for industries and economies worldwide.

Green Hydrogen Developments

The momentum for green hydrogen is accelerating, with significant projects emerging globally. South Korea is poised to construct the world’s largest hydrogen fuel cell power plant in Gyeongju, a $550-million initiative expected to power 270,000 households by March 2028. This project exemplifies the potential of public-private partnerships in enhancing regional clean electricity supply while creating jobs and revitalizing local economies.

In Hong Kong, Sinopec has inaugurated the city’s first public hydrogen refueling station, marking a significant step towards establishing a hydrogen infrastructure. Meanwhile, Slovakia is testing its first hydrogen truck, and Toyota UK has developed ten hydrogen fuel cell Hilux prototypes, showcasing the versatility and potential of hydrogen-powered vehicles.

Innovations in Platinum Technology

The advancements in platinum technology are equally noteworthy. Tanaka, a Japanese company, has developed the world’s first bulk nano-sized platinum, which boasts ten times the hardness and four times the strength of conventional platinum. This breakthrough could open new avenues for specialty applications, particularly in the electronics and aerospace industries, further solidifying platinum’s status as a critical material in various sectors.

Additionally, BMW is introducing hydrogen-powered tugger trains and forklifts at its digital plant in Germany, highlighting the growing integration of hydrogen technologies in industrial applications. The World Platinum Investment Council (WPIC) has also noted the increasing use of platinum in semiconductors and sensors, driven by the surging demand for artificial intelligence (AI) technologies.

The Automotive Sector: A Major Player

Despite the diversification of platinum applications, the automotive sector remains the largest consumer of PGMs, accounting for approximately 40% of total demand. The jewelry industry follows closely, absorbing 25% of platinum production in 2024. Other sectors, including glass, chemicals, and medical applications, also contribute to the overall demand for PGMs.

As the automotive industry pivots towards electrification, the potential for PGMs in battery electric vehicles (BEVs) is gaining attention. North America’s Platinum Group Metals Limited is collaborating with Anglo American Platinum and Florida International University to explore the use of PGMs in BEV batteries, signaling a potential shift in the market landscape.

South Africa’s Role in the Hydrogen Economy

South Africa is uniquely positioned to become a leader in the hydrogen and fuel cell industry. At the recent PGM roundtable hosted by the Mapungubwe Institute for Strategic Reflection (Mistra), experts emphasized the country’s potential to develop a comprehensive hydrogen value chain, from mining and beneficiation to manufacturing and services.

Mistra’s executive director, Joel Netshitenzhe, highlighted the ambitious goal of producing 35 million tonnes of green hydrogen by 2035, which could constitute 20% of the European Union’s energy mix by 2050. Several South African hydrogen projects are currently awaiting final investment decisions, including initiatives in the Northern Cape, Eastern Cape, and Gauteng.

Global Trends and Market Outlook

The global hydrogen market is witnessing a surge in investment, with a coalition of industry representatives at COP29 advocating for increased funding for hydrogen technologies. The WPIC has reported that over $75 billion is already at the final investment decision stage across 434 projects, underscoring the growing recognition of hydrogen’s potential to decarbonize various sectors.

Charbone Hydrogen, North America’s only publicly traded pure-play green hydrogen company, reported a 23% year-on-year revenue increase, reflecting the robust growth in the sector. The company is set to begin green hydrogen production at its Sorel-Tracy facility in Quebec next year, further contributing to the expanding hydrogen economy.

The Future of PGMs in Clean Energy

As the world seeks to combat climate change, the unique properties of PGMs as powerful catalysts are being leveraged for more efficient energy generation and storage. The integration of PGMs in both fuel cell electric vehicles (FCEVs) and BEVs presents a significant market opportunity, particularly if ongoing research into PGM applications in battery technology proves successful.

The potential for PGMs to play a dual role in both hydrogen fuel cells and battery technologies could reshape the landscape of clean energy. With the global push for decarbonization, the demand for PGMs is expected to rise, driven by their critical role in facilitating the transition to a sustainable energy future.

Conclusion

The outlook for platinum group metals is brighter than ever, fueled by advancements in green hydrogen technologies and an expanding array of applications. As countries and industries invest in hydrogen infrastructure and explore innovative uses for PGMs, the potential for economic growth and job creation is immense. With South Africa poised to become a key player in this emerging market, the future of PGMs is not only promising but essential for achieving a sustainable and low-carbon world.