Vancouver, BC – November 5, 2024 – Silver X Mining Corp. (TSXV:AGX)(OTCQB:AGXPF)(F:AGX), a burgeoning silver producer and developer based in Central Peru, has recently announced significant changes to its methodology for calculating All-In Sustaining Cost (AISC). This strategic move aims to provide a more accurate reflection of the company’s operational performance and efficiency, while also enhancing the comparability of its metrics with industry peers.

A New Approach to AISC Calculation

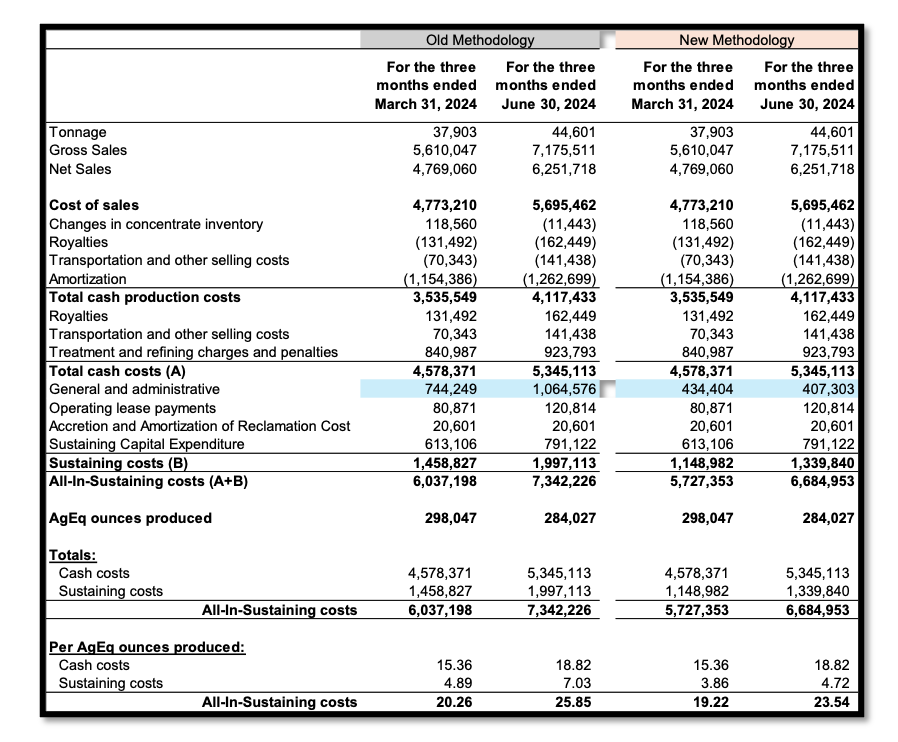

The AISC is a crucial metric in the mining industry, as it encompasses all costs associated with the production of silver, including sustaining capital, operational costs, and administrative expenses. Silver X has refined its approach by adjusting the composition of General & Administrative Expenses included in the AISC calculation. Notably, the company has excluded discretionary costs related to business development, investor relations, and share-based compensation. This change is designed to present a clearer and more accurate view of the company’s operational costs.

CFO David Gleit emphasized the importance of this revision, stating, “This revision in our AISC methodology provides a clearer, more accurate view of our costs and operational efficiency, enhancing transparency and aligning Silver X with industry standards. We believe this change will allow investors and stakeholders to better assess our operational performance as we continue advancing our projects in Peru.”

Impact of the Changes

The adjustments to the AISC methodology have already shown promising results. The company reported significant reductions in sustaining costs and AISC for the three-month periods ending March 31, 2024, and June 30, 2024.

Sustaining Costs

For the period ending March 31, 2024, sustaining costs decreased from $1.4 million to $1.1 million, representing a 21% reduction.

For the period ending June 30, 2024, sustaining costs decreased from $2.0 million to $1.3 million, marking a 33% reduction.

AISC

For the period ending March 31, 2024, AISC decreased from $20.26 to $19.22 per AgEq Oz, reflecting a 5% reduction.

For the period ending June 30, 2024, AISC decreased from $25.85 to $23.54 per AgEq Oz, indicating a 9% reduction.

These improvements not only highlight the effectiveness of the new methodology but also reinforce Silver X’s commitment to operational efficiency and cost management.

Ensuring Transparency and Compliance

Silver X is dedicated to maintaining transparency in its financial reporting. The company ensures that its AISC calculations are fully reconcilable with amounts reported under International Financial Reporting Standards (IFRS). This commitment to transparency is crucial for building trust with investors and stakeholders.

To further facilitate comparisons, Silver X will report both Gross and Net Sales going forward. This approach will allow stakeholders to better assess operating margins by comparing Gross Sales (before treatment and refining charges and penalties) with AISC.

Non-IFRS Measures and Cautionary Notes

It is important to note that cash costs and AISC are non-IFRS financial measures. These metrics do not have standardized meanings prescribed under IFRS, which may limit their comparability with other issuers. Silver X encourages stakeholders to refer to the Non-IFRS Measures section of the company’s most recently filed Management’s Discussion and Analysis for comprehensive details.

Additionally, the company has issued a cautionary note regarding its production decisions. The ongoing operations at the Nueva Recuperada Project are based on economic models and existing estimates of mineral resources, rather than detailed feasibility studies. This introduces certain risks and uncertainties, including the potential for lower-than-expected mineral grades and increased operational costs.

About Silver X Mining Corp.

Silver X is rapidly expanding its footprint in the silver mining sector. The company owns the 20,472-hectare Nueva Recuperada Silver Project in Central Peru and produces silver, gold, lead, and zinc from its Tangana Mining Unit. Silver X is committed to delivering exceptional value to stakeholders by consolidating and developing undervalued assets, increasing production, and fostering sustainable community relationships.

For more information about Silver X Mining Corp., visit their website at www.silverxmining.com.

Conclusion

Silver X Mining Corp.’s recent changes to its AISC methodology represent a significant step towards enhancing operational transparency and efficiency. By refining its cost calculations and ensuring compliance with industry standards, the company is positioning itself for continued growth and success in the competitive silver mining landscape. As Silver X advances its projects in Peru, stakeholders can look forward to a clearer understanding of the company’s operational performance and financial health.