Vancouver, BC / ACCESS Newswire / February 26, 2025 – Silver X Mining Corp. (TSXV:AGX) (OTCQB:AGXPF) (F:AGX), a burgeoning silver producer and developer based in Peru, has unveiled an updated mineral resource estimate for its Nueva Recuperada Property located in Huancavelica, Peru. This announcement is a testament to the company’s ongoing exploration success and its commitment to expanding its resource base, particularly at the Plata Mining Unit, formerly known as Esperanza.

A Landmark Technical Report

The updated resource estimate is encapsulated in a Technical Report prepared by Mr. A. David Heyl, dated February 15, 2025, with an effective date of October 1, 2024. This report adheres to the National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). Investors and stakeholders can access the full report on SEDAR+ at www.sedarplus.ca and on the company’s official website at www.silverxmining.com within the next 45 days.

Key Highlights of the Resource Estimate

The updated mineral resource estimate reveals a substantial increase in resources at the Nueva Recuperada Property:

Measured and Indicated Resources: Increased from 3.60 million tonnes (MT) to 4.26 MT, marking an 18% growth.

Inferred Resources: Rose from 11.89 MT to 17.18 MT, reflecting a remarkable 45% increase.

Plata Mining Unit: This high-quality, historically significant target now boasts indicated recoverable resources of 0.951 MT at an impressive average grade of 6.11 ounces per ton (opt) silver, alongside 4.24% zinc and 2.44% lead. The total contained indicated silver for this unit now stands at 5.81 million ounces (Moz).

Inferred Resources for Plata Mining Unit: Estimated at 5.394 MT with an average grade of 4.82 opt silver, translating to a total contained inferred silver of 26.00 Moz.

Strategic Importance of the Plata Mining Unit

CEO José M. Garcia emphasized the significance of the Nueva Recuperada Property, stating, “Our Nueva Recuperada Property continues to position itself as one of the most relevant silver projects in South America. We are developing an outstanding asset, a district-scale property that will see mining activities for several decades.” The Plata Mining Unit is particularly noteworthy, with 6.35 MT of resources identified across 19 of the 171 mapped veins in the area. This unit is poised for fast-tracked production, aligning with the company’s vision for organic growth in a favorable silver market.

Building on Previous Assessments

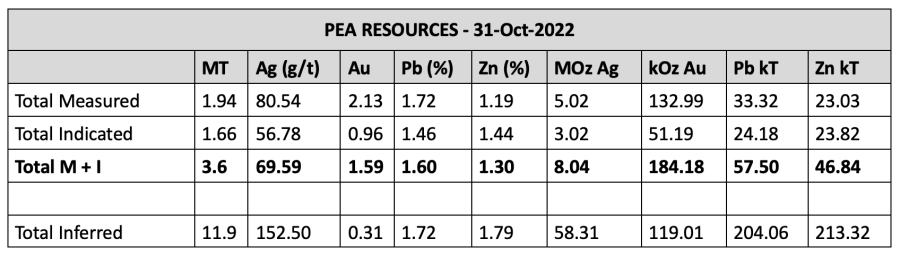

The updated resource estimate builds upon the foundation laid by the Preliminary Economic Assessment (PEA) effective October 31, 2022. The new data reflects significant advancements in understanding geological structures, leading to improved resource classification and estimates. The Plata Mining Unit has seen a 100% increase in indicated resources compared to historical estimates, showcasing the potential for further exploration and development.

Comprehensive Resource Overview

The updated resource estimate consolidates all updated data, illustrating growth across all resource categories. The Plata Mining Unit, strategically located just 15 km from the Nueva Recuperada Plant, benefits from robust logistical support, including established infrastructure and energy access. The unit encompasses eight royalty-free mining concessions covering a total area of 4,228.5 hectares, further solidifying its operational stability.

Exploration Potential and Future Directions

The historical exploration efforts at the Plata Mining Unit have revealed extensive mineralization, with over 120 km of mineralized veins mapped. The exploration potential remains vast, with opportunities to expand both laterally and at depth. Future work will prioritize these areas, particularly focusing on the high-grade Esperanza 2001 Vein, which remains open at depth.

Cautionary Notes and Forward-Looking Statements

It is essential to note that the decision to commence production at the Nueva Recuperada Project is based on economic models and existing estimates of inferred mineral resources. This approach carries inherent risks, including the potential for lower-than-expected mineral grades and challenges in ongoing mining operations. Investors are encouraged to consider these factors when evaluating the company’s future prospects.

Conclusion

Silver X Mining Corp. is on a promising trajectory, with the updated resource estimate for the Nueva Recuperada Property underscoring its potential as a cornerstone asset in the silver market. As the company continues to expand its resource base and production capacity, it presents a compelling opportunity for investors looking to engage with a rapidly growing silver producer. For more information about Silver X Mining Corp., visit www.silverxmining.com.

On Behalf of the Board

José M. García

CEO and Director

For further information, please contact:

Susan Xu

Investor Relations

Email: [protected email]

Phone: +1 778 323 0959

Disclaimer: This article contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those anticipated.