June 22, 2025, 01:54 AM ET

By Thomas H. Kee Jr, Editor, Stock Traders Daily | Editor: Derek Curry

Follow on LinkedIn

In the ever-evolving landscape of stock trading, having a well-structured trading plan is crucial for both novice and seasoned investors. This article delves into the latest trading signals and insights for the CI Gold Bullion Fund (VALT.B:CA), providing a comprehensive overview of the current market conditions and strategic recommendations.

Trading Plans (Long Term)

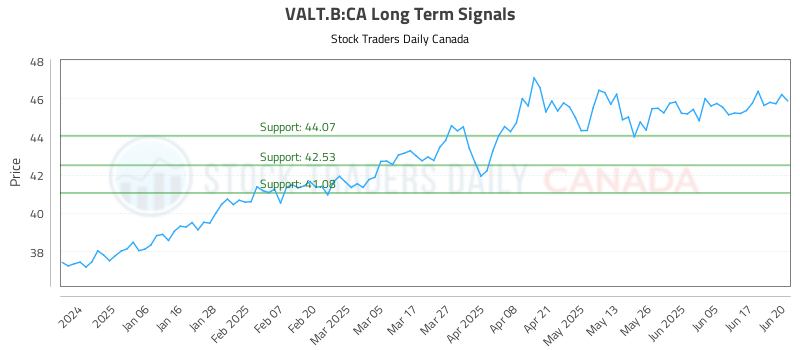

For long-term investors eyeing the CI Gold Bullion Fund, the current recommendation is to buy near 44.07. This price point serves as a strategic entry level, allowing investors to capitalize on potential upward movements in the market. The stop loss is set at 43.85, providing a safety net to mitigate risks associated with market volatility.

No Short Plans Offered

At this time, there are no short plans available for VALT.B:CA. This indicates a bullish sentiment in the market, suggesting that the potential for upward price movement outweighs the risks of downward trends. Investors should remain vigilant, as market conditions can change rapidly.

Updated AI-Generated Signals

The trading signals for VALT.B:CA have been updated, reflecting the latest market analysis. These signals are generated using advanced AI algorithms that analyze various market factors, providing traders with actionable insights.

Current Ratings for VALT.B:CA

As of June 22, the ratings for VALT.B:CA are as follows:

Near Term: Strong

Mid Term: Neutral

Long Term: Strong

These ratings indicate a robust outlook for the near and long-term performance of the CI Gold Bullion Fund, suggesting that investors may want to consider increasing their positions in this asset.

Chart Analysis

A detailed chart for the CI Gold Bullion Fund (VALT.B:CA) is available for those interested in visualizing the stock’s performance. Charts can provide valuable insights into historical price movements, trends, and potential future performance. For a closer look, you can access the chart here.

Conclusion

In summary, the CI Gold Bullion Fund (VALT.B:CA) presents a compelling opportunity for long-term investors. With a recommended buy price of 44.07 and a strong outlook for both near and long-term performance, this fund could be a valuable addition to a diversified investment portfolio. As always, investors should conduct their own research and consider their risk tolerance before making any investment decisions.

For further updates and detailed trading signals, you can check the latest information here.

Stay informed and make strategic decisions to navigate the complexities of the stock market effectively. Happy trading!