Gold has long been revered as a safe-haven asset, a reliable store of value during times of economic uncertainty. However, recent developments have caused this precious metal to lose some of its shine. Following former President Donald Trump’s announcement of potential retaliatory tariffs, gold prices, which had soared to an all-time high of $3,167 per ounce, have since retreated to around $3,027.90 as of April 7, 2025. This article delves into the factors contributing to this decline, the current market sentiment, and the outlook for gold moving forward.

The Tariff Announcement and Its Immediate Effects

The recent drop in gold prices can be traced back to Trump’s announcement regarding tariffs, which reignited fears of a trade war. Initially, the market reacted to the rising tensions with a surge in gold prices, as investors sought refuge in the metal amid uncertainty. However, the announcement also included the exclusion of precious metals from the tariffs, leading to a wave of profit-taking after a remarkable year in which gold prices had risen by 35%.

This profit-taking, combined with a broader sell-off in the markets, has contributed to gold’s decline. Investors, facing losses in other asset classes, have opted to liquidate their gold holdings to offset these losses, further exacerbating the downward pressure on prices.

Safe Haven No More: The Shift in Investor Sentiment

Traditionally viewed as a safe haven, gold’s role has come into question amid the current economic climate. The fear of recession, fueled by escalating trade tensions, has led to a shift in investor sentiment. Instead of flocking to gold as a protective measure, many are selling off their holdings to manage losses elsewhere. This behavior reflects a broader trend in the market, where fear and uncertainty have prompted a reevaluation of asset allocations.

Despite these challenges, some analysts remain optimistic about gold’s long-term prospects. The inherent value of gold as a hedge against inflation and currency devaluation continues to attract interest from institutional investors, who view the current dip as a potential buying opportunity.

Market Predictions: Interest Rates and Future Volatility

The market’s response to the tariff announcement has also influenced expectations regarding interest rates. According to the CME Fed Watch tool, the probability of a 50 basis point rate cut during the Federal Reserve’s June 18, 2025 meeting has surged to 51.70%, up from just 9.8% a week prior. Such a rate cut could provide a boost to gold prices, as lower interest rates typically diminish the opportunity cost of holding non-yielding assets like gold.

However, analysts caution that increased supply and weakened demand could lead to further volatility in the gold market. As investors navigate the uncertain landscape, the potential for sharp price fluctuations remains high.

Technical Analysis: Key Levels and Trading Strategy

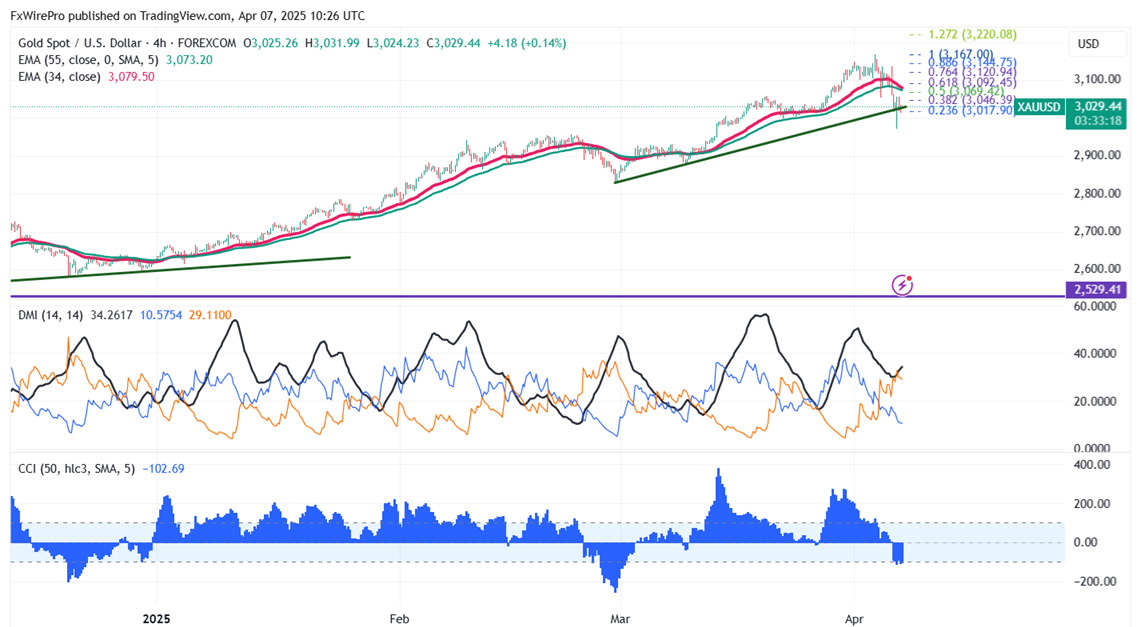

From a technical perspective, gold prices are currently holding above key short-term moving averages, including the 34 and 55 exponential moving averages (EMAs), as well as the long-term 200 EMA on the four-hour chart. Immediate support is identified at $2,970; a break below this level could trigger further declines, with potential targets at $2,956, $2,920, $2,900, and $2,880.

Conversely, near-term resistance is observed at $3,060, with potential price targets extending to $3,070, $3,100, $3,167, $3,200, and $3,255. Traders may consider selling on rallies around the $3,058-$3,060 range, setting a stop-loss at $3,100 and targeting a price of $2,835.

Conclusion: Navigating the Uncertain Waters of Gold Investment

As gold navigates the turbulent waters of economic uncertainty, investors must remain vigilant and adaptable. The recent tariff announcement has undoubtedly impacted gold prices, leading to a sell-off that has raised questions about the metal’s status as a safe haven. While the short-term outlook may appear challenging, the long-term fundamentals for gold remain intact, supported by ongoing geopolitical tensions and potential shifts in monetary policy.

In this complex environment, investors should carefully assess their strategies, keeping an eye on key technical levels and market indicators. Whether gold regains its luster or continues to face headwinds will depend on a multitude of factors, including trade relations, interest rates, and overall market sentiment. As always, informed decision-making will be crucial for those looking to navigate the evolving landscape of gold investment.