November 01, 2025, 12:33 AM ET

By Joseph H., Contributor | Editor: Derek Curry

Follow on LinkedIn

In the ever-evolving landscape of stock trading, having a well-defined trading plan is crucial for both novice and seasoned investors. This article delves into the trading strategies for Alamos Gold Inc. (AGI:CA), providing insights into potential buy and sell signals, as well as an analysis of current market ratings.

Understanding the Trading Plans

Long-Term Buy Strategy

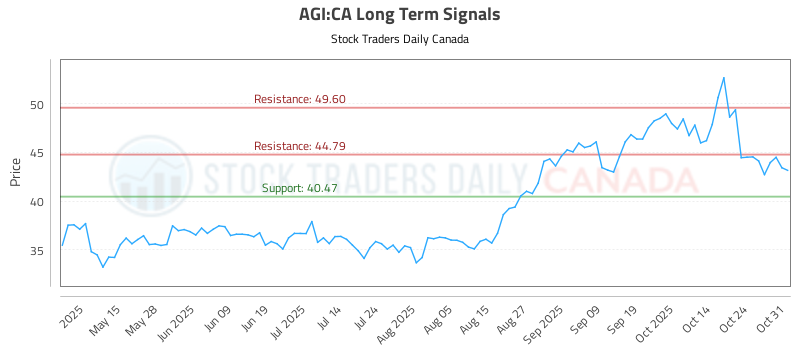

For investors looking to capitalize on Alamos Gold Inc., the recommended buy point is near $40.47. This price level serves as a strategic entry point, allowing traders to position themselves favorably in anticipation of upward momentum. The target for this trade is set at $44.79, representing a potential gain of approximately 10%.

To mitigate risk, a stop loss is advised at $40.27. This stop loss is crucial as it helps protect the investment from significant downturns, ensuring that losses are contained should the market move against the position.

Short-Term Sell Strategy

Conversely, for those considering a short position, the recommendation is to initiate trades near $44.79. This level is identified as a potential peak, where selling pressure may increase. The target for this short trade is set back at $40.47, aiming for a similar 10% return on the downside.

A stop loss for this strategy is placed at $45.01, providing a buffer against unexpected market rallies that could lead to losses. This dual approach allows traders to navigate both upward and downward market movements effectively.

Market Sentiment and Ratings

AGI:CA Ratings for November 1

Understanding market sentiment is vital for making informed trading decisions. As of November 1, the ratings for Alamos Gold Inc. are as follows:

Near Term: Neutral

Mid Term: Weak

Long Term: Strong

These ratings indicate a mixed sentiment surrounding the stock. While the long-term outlook remains robust, the mid-term weakness suggests caution for traders looking to hold positions over the next few months.

AI-Generated Signals for AGI:CA

The integration of AI in trading strategies has revolutionized how investors approach the market. For Alamos Gold Inc., AI-generated signals provide valuable insights into potential price movements. The accompanying chart for AGI:CA can be accessed here, offering a visual representation of the stock’s performance and trends.

The Importance of Timely Data

As trading strategies are heavily reliant on timely and accurate data, it is essential for investors to stay updated. The signals provided for AGI:CA are generated using advanced algorithms that analyze market conditions, historical data, and current trends. This ensures that traders are equipped with the most relevant information to make informed decisions.

Conclusion

In summary, trading Alamos Gold Inc. (AGI:CA) requires a balanced approach that considers both long-term growth potential and short-term market fluctuations. By adhering to the outlined trading plans and staying informed about market ratings and AI-generated signals, investors can navigate the complexities of the stock market with greater confidence.

As always, it is crucial to conduct thorough research and consider personal risk tolerance before executing any trades. The world of trading is dynamic, and staying informed is key to success.

For more detailed insights and updates on Alamos Gold Inc., visit the Stock Traders Daily for the latest signals and analysis.