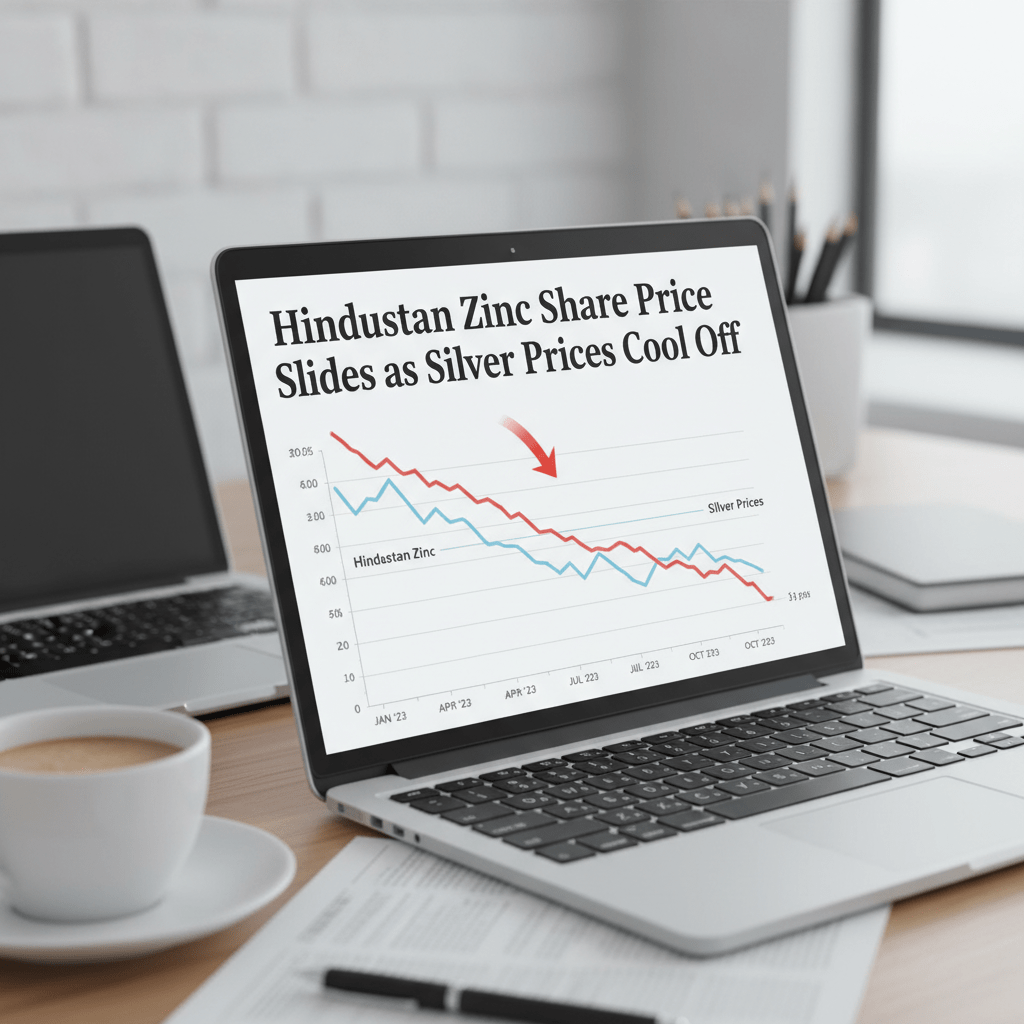

The stock market is a dynamic environment influenced by a myriad of factors, including commodity prices, investor sentiment, and broader economic indicators. Recently, Hindustan Zinc, a prominent player in the mining and metals sector, has seen its share price decline, primarily attributed to falling silver prices. This article delves into the implications of this trend, the factors driving silver prices, and what it means for investors and the broader market.

Understanding Hindustan Zinc

Hindustan Zinc Limited, a subsidiary of Vedanta Limited, is one of the largest producers of zinc and silver in India. The company operates several mines and smelting facilities, contributing significantly to the country’s metal production. As a major player in the silver market, fluctuations in silver prices directly impact Hindustan Zinc’s profitability and, consequently, its share price.

The Current Market Scenario

Recently, Hindustan Zinc’s share price has experienced a noticeable decline. This downturn is closely linked to a broader trend of falling silver prices, which have been influenced by various economic factors. Investors are keenly observing these developments, as they can have significant implications for the company’s financial health and stock performance.

Factors Influencing Silver Prices

Global Economic Conditions: Silver prices are often seen as a barometer of economic health. When economic uncertainty looms, investors typically flock to precious metals as safe-haven assets. Conversely, when the economy shows signs of recovery, demand for silver may decline, leading to lower prices.

Industrial Demand: Silver is not only a precious metal but also a critical component in various industrial applications, including electronics, solar panels, and medical devices. Changes in industrial demand can significantly affect silver prices. Recent trends in manufacturing and technology sectors can provide insights into future demand.

Monetary Policy and Inflation: Central banks’ monetary policies, particularly interest rates, play a crucial role in determining the attractiveness of silver as an investment. Low-interest rates generally boost demand for precious metals, while rising rates can lead to a decline in prices.

Geopolitical Factors: Political instability and geopolitical tensions can lead to fluctuations in silver prices. Investors often turn to silver during times of uncertainty, driving prices up. Conversely, stability can lead to a decrease in demand.

Implications for Hindustan Zinc

The decline in silver prices poses several challenges for Hindustan Zinc:

Revenue Impact: As silver constitutes a significant portion of Hindustan Zinc’s revenue, falling prices can lead to reduced earnings. This decline may affect the company’s ability to reinvest in operations, pay dividends, and maintain its market position.

Investor Sentiment: A drop in share price can lead to negative investor sentiment, potentially resulting in further declines. Investors often react to market trends, and a bearish outlook on silver can lead to a sell-off in Hindustan Zinc shares.

Strategic Adjustments: In response to falling silver prices, Hindustan Zinc may need to reassess its production strategies. This could involve optimizing operations, exploring cost-cutting measures, or diversifying its product offerings to mitigate risks.

Looking Ahead: What Investors Should Consider

For investors considering Hindustan Zinc, several factors should be taken into account:

Market Trends: Keeping an eye on silver market trends and economic indicators can provide valuable insights into potential price movements. Understanding the broader economic landscape will help investors make informed decisions.

Company Fundamentals: Analyzing Hindustan Zinc’s financial health, including its balance sheet, cash flow, and profit margins, is crucial. A strong financial position can help the company weather market fluctuations.

Long-Term Perspective: While short-term price movements can be concerning, a long-term investment perspective may yield better results. Hindustan Zinc’s position as a leading player in the metals sector may provide resilience against market volatility.

Conclusion

The recent slip in Hindustan Zinc’s share price, driven by falling silver prices, highlights the interconnectedness of commodity markets and stock performance. As investors navigate this landscape, understanding the underlying factors influencing silver prices and the company’s strategic responses will be essential. While challenges lie ahead, Hindustan Zinc’s established market presence and operational capabilities may position it well for future recovery and growth.